UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

(Rule 14a-101)

INFORMATION REQUIRED IN PROXY STATEMENT

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrant ☒

Filed by a Party other than the Registrant ☐

Check the appropriate box:

☐Preliminary Proxy Statement

☐ Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

☒ Definitive Proxy Statement

☐ Definitive Additional Materials

☐ Soliciting Material under Rule 14a-12

WAVEDANCER, INC.

(Name of Registrant as Specified in its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

☒ No fee required

☐ Fee paid previously with preliminary materials

☐ Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11

| Letter from the Chairman and Chief Executive Officer |

| G. James Benoit, Jr. |

Dear Stockholder,

We, the Board of Directors of WaveDancer, Inc., cordially invite you to attend our 2023 Annual Meeting of Stockholders (the “Annual Meeting”) to be held via the Internet at 10:00 AM on Wednesday, October 11, 2023. The Annual Meeting will be a completely virtual meeting. You may attend the Annual Meeting, and may submit questions and vote prior to and during the Annual Meeting until polls are closed, at https://agm.issuerdirect.com/WAVD using your shareholder information provided on the proxy card accompanying this Proxy Statement. There is no physical location for the Annual Meeting.

The formal notice of the 2023 Annual Meeting and Proxy Statement have been made a part of this invitation.

At this year’s meeting, we will vote on the election of Jack Johnson and William Pickle as Class II directors, the ratification of the selection of CohnReznick LLP as our independent registered public accounting firm, and an amendment to the Company's Charter to effect a reverse stock split. We will also conduct a non-binding advisory votes to approve the compensation of our Named Executive Officers. Finally, we will transact such other business as may properly come before the meeting.

Whether or not you attend the Annual Meeting virtually, it is important that your shares are represented and voted at the Annual Meeting. You may vote over the Internet or by telephone or, if you requested printed copies of the proxy materials, by mailing a proxy or voting instruction card. Voting over the Internet, by telephone or by written proxy will ensure your representation at the Annual Meeting regardless of whether you attend the meeting virtually.

The Proxy Statement and the Annual Report are available at https://www.iproxydirect.com/wavd and our website at ir.wavedancer.com/sec-filings or by contacting Gwen Pal at Gwen@wavedancer.com.

We look forward to your virtual attendance at our Annual Meeting. Thank you for your ongoing support of, and continued interest in WaveDancer, Inc.

| Sincerely, | |

|

NOTICE OF THE ANNUAL MEETING OF STOCKHOLDERS

TIME AND DATE

Wednesday, October 11, 2023

10:00 a.m. Eastern Daylight Time

|

PLACE

Online only via live webcast at

https://agm.issuerdirect.com/WAVD

|

RECORD DATE

August 22, 2023

|

AGENDA

| At the Annual Meeting, stockholders will be asked to vote on the following proposals: | The Board Recommends a Vote: |

| ITEM 1 | Election of two director nominees named in the Proxy Statement | FOR |

| ITEM 2 | Advisory vote on executive compensation | FOR |

| ITEM 3 | Approval of a reverse stock split at a ratio in the range between 1:5 to 1:15, inclusive | FOR |

|

ITEM 4 |

Ratification of CohnReznick as independent public accountants for 2023 | FOR |

In addition, we will transact any other business properly presented at the meeting, including any adjournment or postponement by or at the direction of the Board of Directors.

Only stockholders of record at the close of business on August 22, 2023 are entitled to notice of and to vote at the Annual Meeting and any adjournments or postponements thereof. We have determined that it is in our and our stockholders’ best interest to hold the Annual Meeting “virtually” via live audio webcast. The virtual Annual Meeting affords our stockholders the same rights and opportunities as an in-person meeting, while allowing them to attend the meeting regardless of their geographic location or other circumstances that could limit their ability to attend an in-person meeting. To attend the Annual Meeting or examine our list of stockholders, go to https://agm.issuerdirect.com/WAVD at the meeting date and time described above and in the accompanying Proxy Statement. There is no physical location for the Annual Meeting.

All stockholders are cordially invited to attend the Annual Meeting virtually. Whether or not you plan to attend, please vote your shares my mail, by telephone or by the internet as promptly as possible. Telephone and internet voting instructions can be found on the notice card. Should you receive more than one proxy because your shares are registered in different names and addresses, each proxy should be signed and returned to assure that all your shares will be voted. You may revoke your proxy at any time prior to the Annual Meeting. If you attend the Annual Meeting virtually and vote, your proxy will be revoked and only your vote at the Annual Meeting will be counted.

The Proxy Statement and our Annual Report for the fiscal year ended December 31, 2022, are available at https://www.iproxydirect.com/wavd or ir.wavedancer.com/sec-filings. You can also access these materials by contacting Gwen Pal at Gwen@wavedancer.com.

| ON BEHALF OF THE BOARD OF DIRECTORS | |

|

|

| G. James Benoit, Jr. Chief Executive Officer |

| Your Vote is Important to us. Regardless of whether you plan to attend, we urge all stockholders to vote on the matters described in the accompanying Proxy Statement. We hope that you will promptly vote and submit your proxy by dating, signing and returning the enclosed proxy card. This will not limit your rights to attend or vote at the Annual Meeting. |

| WaveDancer, Inc. | 2023 Proxy Statement |

12015 Lee Jackson Memorial Highway

Fairfax, Virginia 22033

(703) 383-3000

PROXY STATEMENT

FOR THE 2023 ANNUAL MEETING OF STOCKHOLDERS

To be held on October 11, 2023

The board of directors (the “Board”) of WaveDancer, Inc. (sometimes referred to herein as “we,” “us,” “our,” “WaveDancer” or the “Company”) is soliciting proxies for use at the annual meeting of stockholders (the “Annual Meeting”) to be held at 10:00 a.m. local time on October 11, 2023. This is a virtual meeting which can be accessed via the following internet ling: https://agm.issuerdirect.com/WAVD, as further described below, or at any postponement or adjournment of the Annual Meeting.

QUESTIONS AND ANSWERS ABOUT THESE PROXY MATERIALS AND VOTING

Why did I receive these proxy materials?

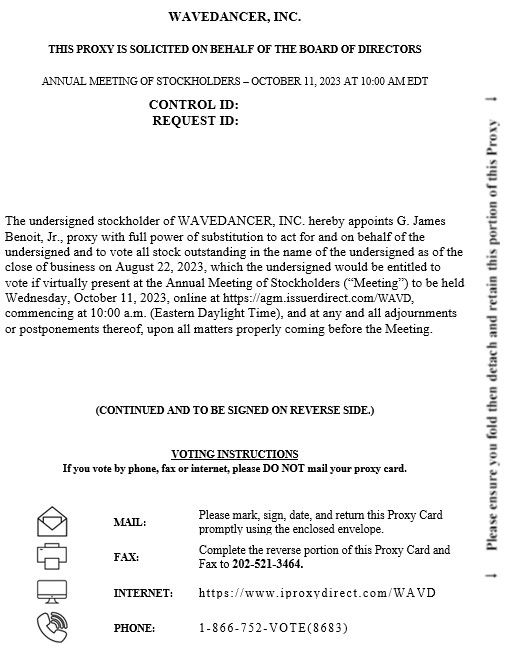

We have sent you this proxy statement and the enclosed proxy card because Board is soliciting your proxy to vote at the Annual Meeting, including any adjournments or postponements of the Annual Meeting. Pursuant to rules adopted by the Securities and Exchange Commission (the “SEC”), we are also providing access to our proxy materials over the internet, which can be accessed at https://www.iproxydirect.com/wavd.

We intend to mail these proxy materials on or about September 5, 2023 to all stockholders of record entitled to vote at the Annual Meeting.

How do I attend the Annual Meeting?

We will host the Annual Meeting live online, via Internet webcast. The Internet webcast will start at 10:00 a.m. EDT, on October 11, 2023. To access the virtual Annual Meeting, please go to https://agm.issuerdirect.com/WAVD. You will have the option to log in to the virtual Annual Meeting as a “Stockholder” with a control number or as a “Guest.” If you are a stockholder of record as of the Record Date, you may log in as a “Stockholder” using the Control ID and Request ID for the Annual Meeting, both of which can be found on your proxy card.

If you are not a stockholder of record, but hold shares in “street name” through a Nominee, you may attend the Annual Meeting as “Guest” by entering your name and email address. As a “Guest”, you will have access to the Annual Meeting materials and will be able to ask questions during the Annual Meeting, but you will not be able to vote during the Annual Meeting. If you hold your shares through a Nominee and you desire to vote during the Annual Meeting, you must register in advance to attend the Annual Meeting as a “Stockholder”. To register to attend the virtual Annual Meeting as a “Stockholder”, you must provide proof of beneficial ownership as of the Record Date, such as an account statement, legal proxy from your Nominee, or similar evidence of ownership along with your name and email address to Issuer Direct.

Whether you attend the Annual Meeting as a “Stockholder” or as a “Guest”, please allow yourself ample time for the online check-in procedures.

Who can vote at the Annual Meeting?

Only stockholders of record at the close of business on August 22, 2023, (the “record date”) will be entitled to vote at the Annual Meeting or any adjournment or postponement thereof. On the record date, there were 19,459,834 shares of common stock outstanding and entitled to vote.

Stockholder of Record: Shares Registered in Your Name

If on the record date your shares were registered directly in your name with the Company’s transfer agent, Issuer Direct, Inc., then you are a stockholder of record. As a stockholder of record, you may vote in person at the meeting or vote by proxy. Whether or not you plan to attend the Annual Meeting, we urge you to vote by proxy pursuant to the instructions set forth below to ensure your vote is counted.

Beneficial Owner: Shares Registered in the Name of a Broker or Bank

If on the record date your shares were held, not in your name, but rather in an account at a brokerage firm, bank, dealer or other similar organization, then you are the beneficial owner of shares held in “street name” and these proxy materials are being forwarded to you by that organization. The organization holding your account is considered to be the stockholder of record for purposes of voting at the Annual Meeting. As a beneficial owner, you have the right to direct your broker or other agent on how to vote the shares in your account. You are also invited to attend the Annual Meeting. However, since you are not the stockholder of record, you may not vote your shares in person at the Annual Meeting unless you request and obtain a valid proxy from your broker or other agent.

How do I ask a question at the Annual Meeting?

By accessing https://agm.issuerdirect.com/WAVD on the Internet, our stockholders will be able to submit questions in writing in advance of or during the Annual Meeting, vote, view the Annual Meeting procedures, and obtain copies of proxy materials. Stockholders will need their unique control number which appears on the proxy card accompanying this Proxy Statement and the instructions that accompanied the proxy materials.

| WaveDancer, Inc. | 2023 Proxy Statement |

Representatives of CohnReznick LLP, our independent registered public accounting firm for the fiscal year ended December 31, 2022, are not expected to be present at the Annual Meeting, and accordingly will not have the opportunity to make a statement or be available to respond to questions.

What am I voting on?

Management is presenting five proposals for stockholder vote:

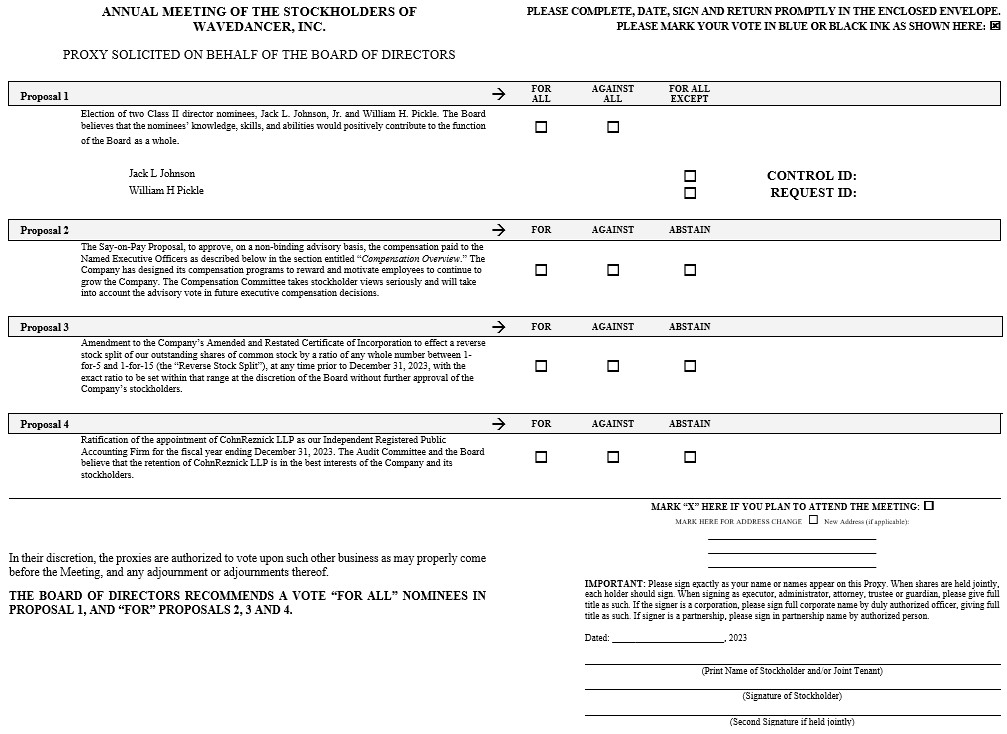

|

● |

Proposal 1: Election of two Class II director nominees, Jack L. Johnson, Jr. and William H. Pickle. The Board believes that the nominees’ knowledge, skills, and abilities would positively contribute to the function of the Board as a whole. |

|

● |

Proposal 2: The Say-on-Pay Proposal, to approve, on a non-binding advisory basis, the compensation paid to the Named Executive Officers as described below in the section entitled “Compensation Overview.” The Company has designed its compensation programs to reward and motivate employees to continue to grow the Company. The Compensation Committee takes stockholder views seriously and will take into account the advisory vote in future executive compensation decisions. |

|

● |

Proposal 3: Amendment to the Company’s Amended and Restated Certificate of Incorporation to effect a reverse stock split of our outstanding shares of common stock by a ratio of any whole number between 1-for-5 and 1-for-15 (the “Reverse Stock Split”), at any time prior to October 31, 2023, with the exact ratio to be set within that range at the discretion of the Board without further approval of the Company’s stockholders. |

|

● |

Proposal 4: The Audit Committee has appointed CohnReznick LLP as our Independent Registered Public Accounting Firm for the fiscal year ending December 31, 2023. The Audit Committee and the Board believe that the retention of CohnReznick LLP is in the best interests of the Company and its stockholders. |

For each proposal, you may vote “For” such proposal, vote “Against” such proposal or “Abstain” from voting on such proposal.

The Board unanimously recommends a vote FOR all of the foregoing proposals.

What if another matter is properly brought before the Annual Meeting?

The Board knows of no other matters that will be presented for consideration at the Annual Meeting. If any other matters are properly brought before the Annual Meeting, it is the intention of the persons named in the accompanying proxy to vote on those matters in accordance with their best judgment.

How do I vote?

The procedures for voting are as follows:

Stockholder of Record: Shares Registered in Your Name

If you are a stockholder of record, you may vote during the Annual Meeting or vote by proxy using the enclosed proxy card, vote by proxy over the telephone or vote by proxy through the internet. Whether or not you plan to attend the Annual Meeting, we urge you to vote by proxy to ensure your vote is counted. You may still attend and vote during the Annual Meeting even if you have already voted by proxy.

|

• |

To vote during the Annual Meeting, please go to https://agm.issuerdirect.com/WAVD. You will have the option to log in to the virtual Annual Meeting as a “Stockholder” or as a “Guest.” If you are a stockholder of record as of the Record Date, you may log in as a “Stockholder” using the Control ID and Request ID for the Annual Meeting, both of which can be found on your proxy card, and you will receive access to an online ballot when you login. |

|

• |

To vote using the proxy card, simply complete, sign and date the enclosed proxy card and return it promptly in the envelope provided. If you return your signed proxy card to us before the Annual Meeting, we will vote your shares as you direct. |

|

• |

To vote over the telephone, dial toll-free 1-866-752-VOTE (8683) using a touch-tone phone and follow the recorded instructions. You will be asked to provide the control ID number and request ID number from the enclosed proxy card. Your telephone vote must be received by 11:59 p.m. on October 10, 2023. |

|

• |

To vote through the internet, go to https://agm.issuerdirect.com/WAVD to complete an electronic proxy card. You will be asked to provide the control ID number and request ID number from the enclosed proxy card. Your internet vote must be received by 11:59 p.m. EDT on October 10, 2023. |

Beneficial Owner: Shares Registered in the Name of Broker or Bank

If you are a beneficial owner of shares registered in the name of your broker, bank, or other agent, you should have received a voting instruction form with this proxy statement from that organization rather than from the Company. Simply complete and mail the voting instruction form to ensure that your vote is counted. Alternatively, you may be able to vote over the Internet as instructed by your broker or bank. To vote during the Annual Meeting, you must obtain a valid proxy from your broker, bank or other agent. Follow the instructions from your broker or bank included with our proxy materials or contact your broker or bank to request a proxy form.

Internet proxy voting may be provided to allow you to vote your shares online, with procedures designed to ensure the authenticity and correctness of your proxy vote instructions. However, please be aware that you must bear any costs associated with your internet access, such as usage charges from internet access providers and telephone companies.

How many votes do I have?

On each matter to be voted upon, you have one vote for each share of common stock you own as of the record date.

| WaveDancer, Inc. | 2023 Proxy Statement |

What if I return a proxy card or otherwise vote by proxy but do not make specific choices?

If you voted by proxy without marking any voting selections, then the proxy holders will vote your shares as recommended by the Board on all matters presented in this proxy statement, and as the proxy holders may determine in their discretion with respect to any other matters properly presented for a vote at the Annual Meeting.

Who is paying for this proxy solicitation?

We will pay for the entire cost of soliciting proxies. In addition to these proxy materials, our directors and employees may also solicit proxies in person, by telephone, or by other means of communication. Directors and employees will not be paid any additional compensation for soliciting proxies. We may also reimburse brokerage firms, banks and other agents for the cost of forwarding proxy materials to beneficial owners.

What does it mean if I receive more than one proxy card?

If you receive more than one proxy card, your shares are registered in more than one name or are registered in different accounts. Please follow the voting instructions with respect to each proxy card to ensure that all of your shares are voted.

Can I change my vote after submitting my proxy?

Yes. You can revoke your proxy at any time before the final vote at the Annual Meeting. If you are a stockholder of record, you may revoke your proxy in any one of the following ways:

|

• |

You may send a written notice that you are revoking your proxy to WaveDancer’s Corporate Secretary at 12015 Lee Jackson Memorial Highway Fairfax, Virginia 22033. |

|

|

• |

You may grant another proxy through the internet. |

|

| • | You may grant another proxy by telephone. | |

|

• |

You may submit another properly completed proxy card with a later date. |

|

|

• |

You may login and attend the virtual Annual Meeting, as described above, and vote. Simply attending the Annual Meeting will not, by itself, revoke your proxy. |

Your most current proxy, whether submitted by proxy card or internet, is the one that is counted.

If your shares are held by your broker or bank as a nominee or agent, you should follow the instructions provided by your broker or bank.

How are votes counted?

The vote required for each proposal and the treatment and effect of abstentions, broker non-votes, and signed but unmarked proxy cards with respect to each proposal are as follows:

|

Proposal |

Votes Required for Approval |

Effect of Abstentions(1) |

Effect of Nominee’s Uninstructed Shares(1) |

Signed but Unmarked Proxy Cards(2) |

|

Proposal 1 |

Majority of votes cast with respect to each nominee |

No effect |

Broker non-vote/ |

Voted “For” each nominee |

|

Proposal 2 |

Majority of shares present and represented by proxy entitled to vote |

Same effect as a vote “Against” |

Broker non-vote/ |

Voted “For” |

|

Proposal 3 |

Majority of shares present and represented by proxy entitled to vote |

Same effect as a vote “Against” |

Broker non-vote/ |

Voted “For”

|

|

Proposal 4 |

Majority of shares present or represented by proxy and entitled to vote |

Same effect as a vote “Against” |

Discretionary vote by Nominee(3) |

Voted “For” |

(1) Abstentions and broker non-votes are included for purposes of determining whether a quorum is present; however, the shares in connection with abstentions are considered “entitled to vote” whereas those in connection with broker non-votes are not.

(2) Except for broker non-votes, if a holder of record completes and returns its proxy card properly, but does not provide instructions on its proxy card as to how to vote its shares, its shares will be voted as shown in this column and in accordance with the judgment of the individuals named as proxies on the proxy card as to any other matter properly brought before the Annual Meeting.

(3) The Nominee is permitted to vote in its discretion with respect to Proposal 4 despite not having received instructions from the beneficial owner.

|

WaveDancer, Inc. |

2023 Proxy Statement |

What are “broker non-votes”?

Broker non-votes occur when a beneficial owner of shares held in street name does not give instructions to the broker or nominee holding the shares as to how to vote on matters deemed “non-routine.” Generally, if shares are held in street name (shares are held by your broker as your nominee), the beneficial owner of the shares is entitled to give voting instructions to the broker or nominee holding the shares. If you do not give instructions to your broker, your broker can vote your shares with respect to matters that are considered to be “routine,” but not with respect to “non-routine” matters. Under the rules and interpretations of various national and regional securities exchanges, “non-routine” matters are matters that may substantially affect the rights or privileges of stockholders. The proposal to ratify the appointment of our independent registered public accounting firm is considered a routine matter. The election of directors, say-on-pay vote, and reverse stock split are non-routine matters; therefore, if you are a beneficial owner of shares held in street name and do not provide voting instructions to your broker on those proposals, your shares will not be voted on those proposals.

What is the quorum requirement?

A quorum of stockholders is necessary to hold a valid Annual Meeting. A quorum will be present if at least a majority of the outstanding shares entitled to vote are represented by stockholders present at the Annual Meeting or by proxy. On the record date, there were 19,459,834 shares outstanding and entitled to vote. Thus, 9,729,918 shares must be represented by stockholders present at the Annual Meeting or by proxy to have a quorum.

Your shares will be counted towards the quorum only if you submit a valid proxy (or one is submitted on your behalf by your broker, bank or other nominee) or if you login to and vote at the Annual Meeting. Abstentions and broker non-votes will be counted towards the quorum requirement. If there is no quorum, the chairman of the Annual Meeting or a majority of the votes present at the Annual Meeting may adjourn the meeting to another date.

How can I find out the results of the voting at the Annual Meeting?

Preliminary voting results will be announced at the Annual Meeting. Final voting results will be published in a current report on Form 8-K that we expect to file no later than four business days after the conclusion of the Annual Meeting. If final voting results are not available to us in time to file a Form 8-K on or before the fourth business day after the Annual Meeting, we intend to file a Form 8-K to publish preliminary results and, within four business days after the final results are known to us, file an additional Form 8-K to publish the final results.

When are stockholder proposals due for the next annual meeting?

To be considered for inclusion in WaveDancer’s proxy materials for our next annual meeting, your proposal must have been submitted in writing to WaveDancer by May 10, 2024. All stockholder proposals should be sent to: WaveDancer, Inc., attention Gwen Pal, Secretary, 12015 Lee Jackson Memorial Highway Ste 210, Fairfax, Virginia 22033.

Whom should I contact with other questions?

If you have additional questions about this proxy statement or the Annual Meeting, or if you would like additional copies of this proxy statement, please contact: WaveDancer, Inc., attention Gwen Pal, Secretary, 12015 Lee Jackson Memorial Highway Ste 210, Fairfax, Virginia 22033.

| WaveDancer, Inc. | 2023 Proxy Statement |

PROPOSAL 1

ELECTION OF DIRECTORS

Proposal 1 is a proposal to elect two persons, Jack L. Johnson, Jr. and William H. Pickle, to serve as directors on our Board. Each of the nominees is currently serving as a director. Our Certificate of Incorporation provides that our Board is divided into three classes, Class I, Class II, and Class III, with members of each class typically serving staggered three-year terms.

The current members of each class of directors are as follows:

|

Name of Nominee |

Age |

Director Since |

Position with the Company |

|||

|

Class I |

||||||

|

Bonnie K. Wachtel |

68 |

1992 |

Director |

|||

|

Class II |

||||||

|

Jack L. Johnson, Jr. |

66 |

2021 |

Director |

|||

|

William H. Pickle |

73 |

2015 |

Director |

|||

|

Class III |

||||||

|

G. James Benoit, Jr. |

51 |

2021 |

Director, CEO and Chairman |

|||

|

Paul B. Becker |

62 |

2021 |

Director |

|||

|

James C. DiPaula, Jr. |

61 |

2021 |

Director |

If elected, each director nominee would hold office until the Annual Meeting of Stockholders in 2026 and until his or her successor is elected and qualified, or his or her earlier death, resignation or removal. Stockholders cannot vote for a greater number of persons than the two nominees named. Both of the Board’s director nominees have consented to be named in this Proxy Statement and to serve as a director, if elected.

If, prior to the Annual Meeting, either of the nominees should be unavailable to serve for any reason, the Board may (i) designate a substitute nominee or nominees (in which event the persons named on the enclosed proxy card will vote the shares represented by all valid proxy cards for the election of such substitute nominee or nominees), (ii) allow the vacancy(ies) to remain open until a suitable candidate or candidates are located, or (iii) by resolution provide for a lesser number of directors. The Board has no reason to believe that any of its nominees will be unable to serve.

This year’s election of directors is an uncontested election of directors, meaning the number of director nominees is equal to or less than the number of directors to be elected at the meeting. In an uncontested election, our directors are elected by majority voting. Under the majority voting standard, a director is elected only if the number of shares voted “For” that director exceeds the number of shares voted “Against” that director. Stockholders do not have the right to cumulate their votes in the election of directors or with respect to any other proposal or matter.

Summarized below is certain information concerning the nominees for director and the directors whose term of office is not expiring at the Annual Meeting, including a brief account of the education and business experience during at least the past five years. There are no family relationships between any director, executive officer, or person nominated to become a director.

Director Nominees and Continuing Directors

Class I Director (Term Expiring in 2025)

Bonnie K. Wachtel, 68, is a principal of Wachtel & Co., Inc., a boutique investment firm based in Washington, D.C. Her career spans investment banking, valuation consulting, and oversight of financial reporting and internal controls. Ms. Wachtel has been a director of six Nasdaq-listed companies since joining her firm in 1984, and currently serves on the Board of VSE Corporation (VSEC), a provider of engineering services principally to federal government clients. From November 2013 through 2021, she was a director of The ExOne Company, (XONE), a global provider of 3D printing machines, products, and services. Her securities industry experience includes service on the Advisory Committee for the National Market System Consolidated Audit Trail, LLC, an entity created by order of the SEC, and ten years on the Hearing Panel for Nasdaq Listing Qualifications. Ms. Wachtel holds B.A. and M.B.A. degrees from the University of Chicago and a J.D. from the University of Virginia. She is a Chartered Financial Analyst (CFA).

Class II Director Nominees (Term Expiring in 2023)

Jack L. Johnson, Jr., 66, is the CEO and Managing Partner for Jack Johnson and Associates, a strategic consulting firm located in McLean, VA. The firm specializes in providing business and risk consulting to clients domestically and internationally, particularly in the areas of business risk, pre- and post-sale merger and acquisition support, business integration as well as in-depth security assessments.

Previously he was a Partner and Sector Leader with Guidehouse Consulting, and its legacy firm, PricewaterhouseCoopers (PwC), where he led the firm’s large Defense Sector Practice after previously serving as Sector Leader for its Homeland Security and Law Enforcement sector. Before joining PwC in 2005, Mr. Johnson served as the first Chief Security Officer (CSO) for the newly formed Department of Homeland Security (DHS). In this capacity, he was directly involved in the establishment of DHS after 9/11 and integrating the 22 agencies that now comprise the Department. His previous government service before his appointment at DHS consisted of over 20 years with the United States Secret Service, rising to the position of Deputy Assistant Director, and serving in a wide range of managerial and executive assignments of increasing responsibility and complexity. His career included the full range of investigative, protective, and intelligence-related duties, both domestically and internationally, as well as assignments with various Presidents, Vice Presidents, Presidential candidates, and foreign heads of state. Prior to being commissioned as a Secret Service Agent in 1983, he was a Police Officer and Detective for Fairfax County, Virginia Police Department, and also is a veteran of the United States Army.

| WaveDancer, Inc. | 2023 Proxy Statement |

Mr. Johnson received his Bachelor of Science degree from the University of Maryland, a Master’s in Forensic Science degree from George Washington University and has completed additional post-graduate study at the University of Virginia and Johns Hopkins School of Management. He has previously testified on multiple occasions before Congress on homeland security and national security-related issues and is a frequent speaker at many national and international conferences, seminars, and symposiums.

William H. Pickle, 73, is a government affairs/business development consultant with over 30 years of experience at senior levels within the federal government. Since 2007, Mr. Pickle has served as President of The Pickle Group, LLC, a Washington DC-based business development company. Mr. Pickle served as the 37th Sergeant at Arms (SAA) of the United States Senate. Mr. Pickle was nominated for this senior position by Senate Majority Leader Bill Frist and elected by the Senate in March 2003. He was re-elected in January 2005. In this position, Mr. Pickle served as the Senate's Chief Operating Officer, Chief of Protocol, Chief of Security; and managed over 950 Senate employees and an annual budget exceeding $200 million. As SAA, Mr. Pickle worked closely with Senators, Committees and senior Senate staff on a daily basis. In addition, as the SAA, he served as Chairman of the U.S. Capitol Police Board with direct oversight for a 2200 person police department with a budget of $300 million. Prior to his Senate service, Mr. Pickle served in several Senior Executive Service (SES) positions within the Executive Branch, which included being the first SES Director of the Transportation Security Administration and a Deputy Inspector General of the Department of Labor.

Most of Mr. Pickle's career was spent with the United States Secret Service where he rose steadily through the ranks from Special Agent to Senior Executive. Mr. Pickle served as Executive Assistant Director responsible for the Congressional and Legislative Affairs program of the Secret Service from 1991 to 1998.

Mr. Pickle is a decorated Vietnam War Veteran who served with the 1st Cavalry Division in 1968-69. Among his awards are the Bronze Star, Purple Heart, 7 Air Medals (2 for valor), 3 Army Commendation Medals, Vietnamese Cross of Gallantry, and the Combat Infantry Badge. Mr. Pickle served on the President's Medal of Valor Award Committee and currently serves on numerous not-for-profit and corporate boards. He was a member of the 2004 Presidential Election Advisory Committee.

Class III Directors (Term Expiring in 2024)

G. James Benoit, Jr., age 51, has spent his career devoted to the intelligence and national security missions of the United States. From 2009 to 2019, he served as the CEO of FedData and Domain5, a pair of technology companies supplying secure hardware, engineering, analytics, network engineering and computer network operations support services to the National Intelligence Community and the Department of Defense. On his watch, FedData grew from start-up to nearly $500 million in revenue and over $30 million in earnings. In 2015, Mr. Benoit led FedData through the acquisition of a distressed asset and successfully turned the asset around. He sold FedData in 2018, earning the stockholders and private equity partners an IRR greater than 80%. As CEO, Mr. Benoit secured over $300 million in asset-based credit facilities, $40 million in revolving facilities and over $75 million in senior unsecured debt. Mr. Benoit most recently led the FedData through the successful capture of a 5-year, more than $500 million, contract supporting the intelligence community. Mr. Benoit retired as CEO of FedData in December 2019. Prior to becoming FedData’s CEO, Mr. Benoit’s career spanned distinguished service as an officer in the United States Army, important work in civilian government, and work in the private sector. A licensed attorney, he spent several years at prominent law firms where he worked on a range of matters including corporate formation, mergers and acquisitions, securities, leveraged buyouts, banking and finance. Mr. Benoit is a graduate of St. Mary’s College of Maryland, the University of Baltimore and the Georgetown University Law Center. A lifelong resident of Annapolis, he lives with his wife and three children.

Paul B. Becker, Rear Admiral, USN (ret), age 62, is a former Naval Intelligence Officer and senior executive with a unique combination of business, military, cyber and leadership experience. As the CEO of “The Becker T3 Group” consultancy he founded in 2016, he leverages an outstanding network of U.S. and international security leaders to provide clients with an understanding of National Security trends and activities. He has successfully developed and implemented all-source intelligence strategies for large, diverse international teams. From 2016 to 2017, Paul led the Presidential Transition’s Intelligence Community Landing Team which provided policy input, strategic guidance and operational counsel to a new administration. He served as Director of Intelligence for the Joint Chiefs of Staff beginning in 2013. Additional military service includes Director of Intelligence for the U.S. Pacific Command in Hawaii and the International Security Assistance Force Joint Command in Afghanistan, commanding officer of CENTCOM’s Joint Intelligence Center in Tampa, and Assistant Naval Attaché to France. Rear Admiral Becker is the recipient of the National Intelligence Community and Department of Defense’s Distinguished Service Medals, and the Ellis Island Medal of Honor. The Naval Intelligence Community recognized RADM Becker in 2016 by establishing the “Teamwork, Tone, Tenacity” leadership award in his honor. He holds a Master’s degree in Public Administration from Harvard's Kennedy School of Government and a Bachelor of Science from the U.S. Naval Academy. A dynamic public speaker and author, his articles and presentations have been widely published.

James C. “Chip” DiPaula, Jr., age 61, is Co-President of the Digital Commerce Division of Ascential plc. Mr. DiPaula is Co-Founder of Flywheel Digital, a pioneering digital advertising firm that optimizes ecommerce sales for the world’s largest brands. Flywheel was acquired in 2018 by Ascential, plc. Mr. DiPaula’s public sector experience includes serving as Chief of Staff to the Governor of Maryland from 2005 to 2007 and serving as the youngest Secretary of the Maryland Department of Budget & Management in state history from 2003 to 2005. In this capacity, he oversaw development of a $26 billion state budget and resolved $4 billion in budget deficits through performance-based budgeting. Mr. DiPaula received his Bachelor of Science degree in Business Administration from Towson University.

The Board recommends that stockholders vote FOR each of the Class II director nominees named above for re-election to the Board.

| WaveDancer, Inc. | 2023 Proxy Statement |

PROPOSAL 2

ADVISORY VOTE TO APPROVE NAMED EXECUTIVE COMPENSATION

Pursuant to Section 14A of the Securities Exchange Act of 1934, we are asking stockholders to cast an advisory vote to approve the compensation on our Named Executive Officers as discussed in the section entitled “Executive Compensation” in this Proxy Statement. While this vote is non-binding, we value the opinions of our stockholders and, consistent with our record of stockholder engagement, will consider the outcome of the vote when making future compensation decisions. This proposal, commonly known as a “say-on-pay” proposal, gives you, as a stockholder, the opportunity to endorse the executive compensation programs and policies and the compensation paid to our Named Executive Officers.

We believe in the power of open disclosure and know the only way to build and strengthen our reputation and our Company is through honesty and trust. In connection with that belief and as required by SEC rules, we are asking our stockholders to approve, on an advisory basis, the compensation of our Named Executive Officers.

As discussed under the heading “Executive Compensation” in this Proxy Statement, the Compensation Committee’s compensation objectives are to: attract and retain highly qualified individuals with a demonstrated record of achievement; reward past performance; provide incentives for future performance; and align the interests of the Named Executive Officers with the interests of our stockholders. The Board is asking stockholders to support this proposal based on the disclosure set forth in these sections of this Proxy Statement, which, among other things, demonstrates:

|

● |

our commitment to ensuring executive compensation is aligned with our corporate strategies and business objectives and is competitive with those of other companies in our industry; |

|

● |

the design of our compensation programs is intended to reward our Named Executive Officers for the achievement of key strategic and financial performance measures; and |

|

● |

our strong emphasis on the alignment of the incentives of our Named Executive Officers with the creation of increased stockholder value. |

The Board recommends that stockholders to vote FOR, in a non-binding vote, the following resolution:

“RESOLVED, the stockholders of WaveDancer, Inc. approve on an advisory basis, the compensation paid to our Named Executive Officers as disclosed pursuant to the compensation disclosure rules of the SEC, including the compensation tables and accompanying narrative disclosure under the heading “Executive Compensation” included in the Proxy Statement.”

| WaveDancer, Inc. | 2023 Proxy Statement |

PROPOSAL 3

APPROVAL OF AN AMENDMENT TO OUR CERTIFICATE OF INCORPORATION TO EFFECT A REVERSE STOCK SPLIT OF OUR OUTSTANDING SHARES OF COMMON STOCK BY A RATIO OF ANY WHOLE NUMBER BETWEEN 1-FOR-5 AND 1-FOR-15, AT ANY TIME PRIOR TO OCTOBER 31, 2023, WITH THE EXACT RATIO TO BE SET WITHIN THAT RANGE AT THE DISCRETION OF OUR BOARD WITHOUT FURTHER APPROVAL OR AUTHORIZATION OF OUR STOCKHOLDERS.

General

We are seeking stockholder approval to grant the Board discretionary authority to amend the Charter to effect a reverse stock split of the issued and outstanding shares of our common stock by a ratio of any whole number between 1-for-5 and 1-for-15, at any time prior to October 31, 2023 (the “Reverse Stock Split”). A copy of the form of certificate of amendment for the Reverse Stock Split is attached to this Proxy Statement as Appendix A. One of the primary reasons we are seeking stockholder approval of a reverse stock split is that we believe it will enable us to regain compliance with the Nasdaq Capital Market listing requirements.

The Reverse Stock Split will not change the number of authorized shares of common stock or preferred stock or the relative voting power of such holders of our outstanding common stock and preferred stock. The number of authorized but unissued shares of our common stock will materially increase and will be available for reissuance by the Company. The Reverse Stock Split, if effected, would affect all of our stockholders uniformly.

The Board unanimously approved, and recommended seeking stockholder approval of, the Reverse Stock Split, on August 1, 2023. If this Reverse Stock Split is approved by the stockholders, the Board will have the authority, in its sole discretion, without further action by the stockholders, to effect the Reverse Stock Split. The Board’s decision as to whether and when to effect the Reverse Stock Split, if approved by the stockholders, will be based on a number of factors, including prevailing market conditions, existing and expected trading prices for our common stock, actual or forecasted results of operations, and the likely effect of such results on the market price of our common stock.

A reverse stock split will also affect our outstanding stock options and our outstanding warrants. Under our stock option incentive plans and warrant securities, the number of shares of common stock deliverable upon exercise or grant must be appropriately adjusted and appropriate adjustments must be made to the purchase price per share to reflect the Reverse Stock Split.

The Reverse Stock Split is not being proposed in response to any effort of which we are aware to accumulate our shares of common stock or obtain control of the Company, nor is it a plan by management to recommend a series of similar actions to the Board or our stockholders.

There are certain risks associated with a reverse stock split, and we cannot accurately predict or assure the Reverse Stock Split will produce or maintain the desired results (for more information on the risks see the section below entitled “Certain Risks Associated with a Reverse Stock Split”). The Board believes that the benefits to the Company outweigh the risks and recommends that you vote in favor of granting the Board the discretionary authority to effect the Reverse Stock Split.

Reasons for the Reverse Stock Split

The Board believes that effecting the Reverse Stock Split would increase the price of our common stock which would, among other things, help us to:

|

● |

meet the minimum bid price listing requirement of the Nasdaq Capital Market; |

|

● |

appeal to a broader range of investors to generate greater interest in the Company; and |

|

● |

improve perception of our common stock as an investment security |

Meet Nasdaq Listing Requirements - Our common stock is listed on the Nasdaq Capital Market under the symbol WAVD. On December 9, 2022, we received a deficiency letter from the Nasdaq Listing Qualifications Department of the Nasdaq Stock Market LLC (“Nasdaq”), notifying us that, for the previous 30 consecutive trading days, the closing bid price for our common stock was below the minimum $1.00 per share required for continued listing on the Nasdaq Capital Market pursuant to Nasdaq Listing Rule 5550(a)(2) (“Rule 5550(a)(2)”). In accordance with Nasdaq Listing Rule 5810(c)(3)(A), we were given 180 calendar days, or until June 7, 2023, to regain compliance with Rule 5550(a)(2). The Company did not regain compliance as of that date and, after a hearing with the Nasdaq Hearing Panel (the “Panel”), on August 8, 2023, we were granted an extension until October 31, 2023 (the “Compliance Date”) to regain compliance with Rule 5550(a)(2). As of the date of this Proxy, we were not in compliance with Rule 5550(a)(2). If we do not regain compliance with Rule 5550(a)(2) by the Compliance Date, the Nasdaq staff will provide written notification to us that our common stock will be subject to immediate delisting. Although we believe that implementing the Reverse Stock Split is likely to lead to compliance with Rule 5550(a)(2), there can be no assurance that the closing share price after implementation of the Reverse Stock Split will succeed in restoring such compliance.

Appeal to a Broader Range of Investors to Generate Greater Investor Interest in the Company – An increase in our stock price may make our common stock more attractive to investors. Brokerage firms may be reluctant to recommend lower-priced securities to their clients. Many institutional investors have policies prohibiting them from holding lower-priced stocks in their portfolios, which reduces the number of potential purchasers of our common stock. Investment funds may also be reluctant to invest in lower-priced stocks. Investors may also be dissuaded from purchasing lower-priced stocks because the brokerage commissions, as a percentage of the total transaction, tend to be higher for such stocks. Moreover, the analysts at many brokerage firms do not monitor the trading activity or otherwise provide coverage of lower-priced stocks. Giving the Board the ability to effect the Reverse Stock Split, and thereby increase the price of our common stock, would give the Board the ability to address these issues if it is deemed necessary.

We are exploring various sources of financing, including potential future sales of common stock or other securities. There can be no assurance, however, even if the Reverse Stock Split is approved and implemented, that any financing transaction will be undertaken or completed. If we are unable to successfully raise sufficient additional capital, through future sales of common stock or other securities or through strategic and collaborative arrangements, we will not have sufficient cash to fund our planned business operations and or may not be able to continue as a going concern.

| WaveDancer, Inc. | 2023 Proxy Statement |

Improve the Perception of Our Common Stock as an Investment Security – The Board believes that effecting the Reverse Stock Split is one potential means of increasing the share price of our common stock to improve the perception of our common stock as a viable investment security. Lower-priced stocks have a perception in the investment community as being risky and speculative, which may negatively impact not only the price of our common stock, but also our market liquidity.

Certain Risks Associated with the Reverse Stock Split

Even if a reverse stock split is effected, some or all of the expected benefits discussed above may not be realized or maintained. The market price of our common stock will continue to be based, in part, on our performance and other factors unrelated to the number of shares outstanding. The Reverse Stock Split will reduce the number of outstanding shares of our common stock without reducing the number of shares of available but unissued common stock, which will also have the effect of increasing the number of shares of common stock available for issuance. The issuance of additional shares of our common stock would have a dilutive effect on the ownership of existing stockholders. The current economic environment in which we operate, the debt we carry, along with otherwise volatile equity market conditions, could limit our ability to raise new equity capital in the future.

Effects of the Reverse Stock Split

If our stockholders approve the proposed Reverse Stock Split and the Board elects to effect the Reverse Stock Split, our issued and outstanding shares of common stock, for example, would decrease at a rate of approximately one (1) share of common stock for every five (5) shares of common stock currently outstanding in a 1-for-5 split. The Reverse Stock Split would be effected simultaneously for all of our common stock, and the exchange ratio would be the same for all shares of common stock. The Reverse Stock Split would affect all of our stockholders uniformly and would not affect any stockholders’ percentage ownership interests in the Company, except due to rounding fractional shares up to the nearest whole share. The Reverse Stock Split would not affect the relative voting or other rights that accompany the shares of our common stock, except due to rounding fractional shares up to the nearest whole share. Common stock issued pursuant to the Reverse Stock Split would remain fully paid and non-assessable. The Reverse Stock Split would not affect our securities law reporting and disclosure obligations, and we would continue to be subject to the periodic reporting requirements of the Securities Exchange Act of 1934, as amended. We have no current plans to take the Company private. Accordingly, the Reverse Stock Split is not related to a strategy to do so.

In addition to the change in the number of shares of common stock outstanding, the Reverse Stock Split would have the following effects:

Increase the Per Share Price of our Common Stock – By effectively condensing a number of pre-split shares into one share of common stock, the per share price of a post-split share is generally greater than the per share price of a pre-split share. The amount of the initial increase in per share price and the duration of such increase, however, is uncertain. The Board may utilize the Reverse Stock Split as part of its plan to maintain the required minimum per share price of the common stock under the Nasdaq listing standards.

Increase in the Number of Shares of Common Stock Available for Future Issuance – By reducing the number of shares outstanding without reducing the number of shares of available but unissued common stock, the Reverse Stock Split will increase the number of authorized but unissued shares. The Board believes the increase is appropriate for use to fund the future operations of the Company. Although the Company does not have any pending acquisitions for which shares are expected to be used, the Company may also use authorized shares in connection with the financing of future acquisitions.

The following table contains approximate information relating to our common stock, based on share information as of the record date:

|

After the Reverse Stock Split 1 |

|||||

|

Current |

If Maximum 1:5 Ratio is Selected |

If Maximum 1:15 Ratio is Selected |

|||

|

Authorized Common Stock |

100,000,000 |

100,000,000 |

100,000,000 |

||

|

Common stock Issued and Outstanding as of the Record Date |

19,459,834 |

3,891,966 |

1,297,322 |

||

|

Reserved for Issuance 2 |

3,789,432 |

757,886 |

252,628 |

||

|

Total |

23,249,266 |

4,649,852 |

1,549,950 |

||

|

Available for Issuance |

76,750,734 |

95,350,148 |

98,450,050 |

||

|

(1) |

Does not take into account that fractional shares resulting from the Reverse Split will not be issued and instead, stockholders will receive an amount equal to the fair market value of such fractional shares at the time of the Reverse Stock Split. |

|

(2) |

Includes shares of common stock reserved for issuance upon the exercise of currently exercisable options and warrants |

Although the Reverse Stock Split would not have any dilutive effect on our stockholders, the Reverse Stock Split without a reduction in the number of shares authorized for issuance would reduce the proportion of shares owned by our stockholders relative to the number of shares authorized for issuance, giving the Board an effective increase in the authorized shares available for issuance, in its discretion. The Board from time to time may deem it to be in the best interests of the Company to enter into transactions and other ventures that may include the issuance of shares of our common stock. If the Board authorizes the issuance of additional shares subsequent to the Reverse Stock Split, the dilution to the ownership interest of our existing stockholders may be greater than would occur had the Reverse Stock Split not been effected.

Require Adjustment to Currently Outstanding Securities Exercisable into Shares of our Common Stock – The Reverse Stock Split would effect a reduction in the number of shares of common stock issuable upon the exercise or conversion of our outstanding stock options and the exercise of our outstanding warrants in proportion to the Reverse Stock Split ratio. The exercise price of outstanding options and warrants would increase, likewise, in proportion to the Reverse Stock Split ratio.

Require Adjustment to the Number of Shares of Common Stock Available for Future Issuance Under our 2021 Stock Incentive Plan – In connection with any reverse stock split, the Board would also make a corresponding reduction in the number of shares available for future issuance under the foregoing plan so as to avoid the effect of increasing the number of authorized but unissued shares available for future issuance under such plans.

| WaveDancer, Inc. | 2023 Proxy Statement |

In addition, the Reverse Stock Split may result in some stockholders owning “odd lots” of less than one hundred (100) shares of common stock, which may be more difficult to sell and may cause those holders to incur greater brokerage commissions and other costs upon sale.

Procedure for Effecting Reverse Stock Split and Exchange of Stock Certificates

If the Reverse Stock Split is approved by our stockholders, the Board, in its sole discretion, would determine whether to implement the Reverse Stock Split, taking into consideration the factors discussed above, and, if implemented, determine the ratio of the Reverse Stock Split.

We would then file a Certificate of Amendment to the Company's Certificate of Incorporation with the Secretary of the State of Delaware. The form of the Certificate of Amendment is attached to this Proxy Statement as Appendix A and is considered a part of this Proxy Statement. Upon the filing of the Certificate of Amendment, without any further action on our part or our stockholders, the issued shares of common stock held by stockholders of record as of the effective date of the Reverse Stock Split would be converted into a lesser number of shares of common stock calculated in accordance with the Reverse Stock Split ratio of any whole number between 1-for-5and 1-for-15, at any time prior to October 31, 2023.

Effect on Beneficial Holders (i.e., Stockholders Who Hold in “Street Name”)

If the proposed Reverse Stock Split is approved and effected, we intend to treat common stock held by stockholders in “street name,” through a bank, broker or other nominee, in the same manner as stockholders whose shares are registered in their own names. Banks, brokers or other nominees will be instructed to effect the Reverse Stock Split for their customers holding common stock in “street name.” However, these banks, brokers or other nominees may have different procedures than registered stockholders for processing the Reverse Stock Split. If you hold shares of common stock with a bank, broker or other nominee and have any questions in this regard, you are encouraged to contact your bank, broker or other nominee.

Effect on Registered “Book-Entry” Holders (i.e., Stockholders That are Registered on the Transfer Agent’s Books and Records but do not Hold Certificates)

Some of our registered holders of common stock may hold some or all of their shares electronically in book-entry form with our transfer agent, Issuer Direct. These stockholders do not have stock certificates evidencing their ownership of common stock. They are, however, provided with access to a statement reflecting the number of shares registered in their accounts. If a stockholder holds registered shares in book-entry form with our transfer agent, no action needs to be taken to receive post-reverse stock split shares. If a stockholder is entitled to post-reverse stock split shares, a transaction statement will automatically be sent to the stockholder’s address of record indicating the number of shares of common stock held following the Reverse Stock Split.

Fractional Shares

No fractional shares will be issued in connection with the reverse stock split. If the number of shares of post-split common stock for any shareholder includes a fraction, such fractional shares will be rounded up to the nearest whole share. Ownership percentages are not expected to change meaningfully as a result of rounding up fractional shares that result from the exchange. Similarly, no fractional shares will be issued on the exercise of outstanding stock options, awards or rights, except as otherwise expressly specified in the documents governing such options or rights.

Accounting Matters

The par value of our common stock would remain unchanged at $0.001 per share, if the Reverse Stock Split is effected.

The Company’s stockholders’ equity in its consolidated balance sheet would not change in total. However, the Company’s stated capital (i.e., $0.001 par value times the number of shares issued and outstanding), would be proportionately reduced based on the reduction in shares of common stock outstanding. Additional-paid-in capital would be increased by an equal amount, which would result in no overall change to the balance of stockholders’ equity.

Additionally, net income or loss per share for all periods would increase proportionately as a result of the Reverse Stock Split since there would be a lower number of shares outstanding. We do not anticipate that any other material accounting consequences would arise as a result of the Reverse Stock Split.

Potential Anti-Takeover Effect

Even though the proposed Reverse Stock Split would result in an increased proportion of unissued authorized shares to issued shares, which could, under certain circumstances, have an anti-takeover effect (for example, by permitting issuances that would dilute the stock ownership of a person seeking to effect a change in the composition of the Board or contemplating a tender offer or other transaction for the combination of us with another company), the Reverse Stock Split is not being proposed in response to any effort of which we are aware to accumulate shares of our common stock or obtain control of us, nor is it part of a plan by management to recommend a series of similar amendments to the Board and our stockholders.

No Appraisal Rights

Our stockholders are not entitled to appraisal rights with respect to the Reverse Stock Split, and we will not independently provide stockholders with any such right.

| WaveDancer, Inc. | 2023 Proxy Statement |

Certain Federal Income Tax Consequences of the Reverse Stock Split

The following summary describes certain U.S. federal income tax consequences of the Reverse Stock Split to holders of our common stock. This summary addresses the tax consequences only to a U.S. holder, which is a beneficial owner of our common stock that is either:

|

● |

an individual citizen or resident of the United States; |

|

● |

a corporation, or other entity taxable as a corporation for U.S. federal income tax purposes, created or organized in or under the laws of the United States or any state thereof or the District of Columbia; |

|

● |

an estate, the income of which is subject to U.S. federal income taxation regardless of its source; or |

|

● |

a trust, if: (i) a court within the United States is able to exercise primary jurisdiction over its administration and one or more U.S. persons has the authority to control all of its substantial decisions or (ii) it was in existence before August 20, 1996 and a valid election is in place under applicable Treasury regulations to treat such trust as a U.S. person for U.S. federal income tax purposes. |

This summary is based on the provisions of the Internal Revenue Code of 1986, as amended (the “Code”), U.S. Treasury regulations, administrative rulings and judicial authority, all as in effect as of the date of this proxy statement. Subsequent developments in U.S. federal income tax law, including changes in law or differing interpretations, which may be applied retroactively, could have a material effect on the U.S. federal income tax consequences of the Reverse Stock Split.

This summary does not address all of the tax consequences that may be relevant to any particular investor, including tax considerations that arise from rules of general application to all taxpayers or to certain classes of taxpayers or that are generally assumed to be known by investors. This summary also does not address the tax consequences to (i) persons that may be subject to special treatment under U.S. federal income tax law, such as banks, insurance companies, thrift institutions, regulated investment companies, real estate investment trusts, tax-exempt organizations, U.S. expatriates, persons subject to the alternative minimum tax, persons whose functional currency is not the U.S. dollar, partnerships or other pass-through entities, traders in securities that elect to mark to market and dealers in securities or currencies, (ii) persons that hold our common stock as part of a position in a “straddle” or as part of a “hedging transaction,” “conversion transaction” or other integrated investment transaction for federal income tax purposes or (iii) persons that do not hold our common stock as “capital assets” (generally, property held for investment). This summary does not address backup withholding and information reporting. This summary does not address U.S. holders who beneficially own common stock through a “foreign financial institution” (as defined in Code Section 1471(d)(4)) or certain other non-U.S. entities specified in Code Section 1472. This summary does not address tax considerations arising under any state, local or foreign laws, or under federal estate or gift tax laws.

If a partnership (or other entity classified as a partnership for U.S. federal income tax purposes) is the beneficial owner of our common stock, the U.S. federal income tax treatment of a partner in the partnership will generally depend on the status of the partner and the activities of the partnership. Partnerships that hold our common stock, and partners in such partnerships, should consult their own tax advisors regarding the U.S. federal income tax consequences of the Reverse Stock Split.

General Tax Treatment of the Reverse Stock Split

The Reverse Stock Split is intended to qualify as a “reorganization” under Section 368 of the Code that should constitute a “recapitalization” for U.S. federal income tax purposes. Assuming the Reverse Stock Split qualifies as a reorganization, the Company should not recognize gain or loss. Further, assuming the Reverse Stock Split qualifies as a reorganization, a U.S. holder generally should not recognize gain or loss upon the exchange of our common shares for a lesser number of common shares, based upon the reverse stock split ratio. A U.S. holder’s aggregate tax basis in the lesser number of common shares received in the Reverse Stock Split will be the same such U.S. holder’s aggregate tax basis in the shares of our common stock that such U.S. holder owned prior to the Reverse Stock Split. The holding period for the ordinary shares received in the Reverse Stock Split will include the period during which a U.S. holder held the shares of our common stock that were surrendered in the Reverse Stock Split. The United States Treasury regulations provide detailed rules for allocating the tax basis and holding period of the shares of our common stock surrendered to the shares of our common stock received pursuant to the Reverse Stock Split. U.S. holders of shares of our common stock acquired on different dates and at different prices should consult their tax advisors regarding the allocation of the tax basis and holding period of such shares.

THE FOREGOING IS A SUMMARY OF CERTAIN FEDERAL INCOME TAX CONSEQUENCES OF THE REVERSE STOCK SPLIT AND DOES NOT CONSTITUTE A TAX OPINION. EACH HOLDER OF OUR COMMON STOCK SHOULD CONSULT ITS OWN TAX ADVISOR REGARDING THE TAX CONSEQUENCES OF THE REVERSE STOCK SPLIT AND FOR REFERENCE TO THE APPLICABLE PROVISIONS OF THE CODE.

| WaveDancer, Inc. | 2023 Proxy Statement |

Dissenters’ Rights

No dissenters’ rights are available under the General Corporation Law of the State of Delaware or under the Certificate of Incorporation or the Bylaws to any stockholder who dissents from this Proposal.

Interests of Directors and Executive Officers

Our directors and executive officers have no substantial interests, directly or indirectly, in the matters set forth herein regarding the proposed Reverse Stock Split except to the extent of their ownership of shares of our common stock.

Reservation of Right to Abandon Reverse Stock Split

We reserve the right to abandon the Reverse Stock Split without further action by our stockholders at any time before the effectiveness of the filing with the Secretary of State of the State of Delaware of the Certificate of Amendment to the Charter, even if the authority to effect the Reverse Stock Split has been approved by our stockholders at the Special Meeting. By voting in favor of the Reverse Stock Split, you are expressly also authorizing the Board to delay, not to proceed with, and abandon, the Reverse Stock Split if it should so decide, in its sole discretion, that such action is in the best interests of the Company.

Vote Required for Approval of this Proposal

The approval of the amendment to the Company’s Restated Certificate of Incorporation to effect a reverse stock split requires the affirmative votes of a majority of the shares of common stock present in person or virtually or represented by proxy and entitled to vote on the proposal. Abstentions will have the effect of negative votes; broker non votes will have no effect on the outcome of the proposal.

Recommendation

THE BOARD RECOMMENDS THAT YOU VOTE “FOR” AN AMENDMENT TO OUR AMENDED AND RESTATED CERTIFICATE OF INCORPORATION TO EFFECT A REVERSE STOCK SPLIT OF OUR OUTSTANDING SHARES OF COMMON STOCK BY A RATIO OF ANY WHOLE NUMBER BETWEEN

1-FOR-5 AND 1-FOR-15 AT ANY TIME PRIOR TO OCTOBER 31, 2023, WITH THE EXACT RATIO TO BE SET WITHIN THAT RANGE AT THE DISCRETION OF OUR BOARD WITHOUT FURTHER APPROVAL OR AUTHORIZATION OF OUR STOCKHOLDERS.

| WaveDancer, Inc. | 2023 Proxy Statement |

PROPOSAL 4

RATIFICATION OF INDEPENDENT REGISTERED PUBLIC ACCOUNTANTS

The Audit Committee has appointed CohnReznick LLP ("CohnReznick") as our independent registered public accounting firm, to audit our financial statements for the fiscal year ending December 31, 2023. The Board proposes that the stockholders ratify this appointment. CohnReznick audited our financial statements for the fiscal year ended December 31, 2022. We expect that representatives of CohnReznick will not be present at the meeting, will therefore be unable to make a statement, and will not be available to respond to appropriate questions.

The Audit Committee directly engages CohnReznick as it relates to the audit and reviews of the Company’s annual and quarterly, respectively, consolidated financial statements. In accordance with its written charter, our Audit Committee pre-approves all audit and permissible non-audit services, including the scope of contemplated services and the related fees, that are to be performed by CohnReznick, subject to the de minimis exceptions described in Section 10A(i)(1)(B) of the Exchange Act, which are approved by the Audit Committee prior to the completion of the audit. The Audit Committee’s pre-approval of non-audit services involves consideration of the impact that providing such services may have on CohnReznick’s independence.

Although stockholder approval of the Board of Directors’ selection of CohnReznick is not required by law, the Board believes that it is advisable to give stockholders an opportunity to ratify this selection.

In the event the stockholders do not ratify the appointment of CohnReznick, as our independent registered public accountants, the Audit Committee will reconsider its appointment.

The affirmative vote of a majority of the shares present or represented and entitled to vote at the Annual Meeting is required to ratify the appointment of the independent registered public accountants.

The Board recommends a vote “FOR” the ratification of CohnReznick as the independent registered public accounting firm.

| WaveDancer, Inc. | 2023 Proxy Statement |

BOARD OF DIRECTORS AND CORPORATE GOVERNANCE

Committees of our Board of Directors

Our Board of Directors has established the following standing committees: Audit Committee and Compensation, Nominating & Governance Committee. The composition and responsibilities of each of the committees of our Board of Directors is described below.

Audit Committee

Our Audit Committee met four times during 2022. This committee currently has three members, Bonnie K. Wachtel (Chair), James C. DiPaula and Paul B. Becker. Our Audit Committee has the authority to retain and terminate the services of our independent registered public accounting firm, reviews annual financial statements, considers matters relating to accounting policy and internal controls and reviews the scope of annual audits. All members of the Audit Committee satisfy the current independence standards promulgated by the SEC and by the NASDAQ Stock Market; as such standards apply specifically to members of audit committees. The Board has determined that Ms. Wachtel is our “audit committee financial expert,” as the SEC has defined that term in Item 407 of Regulation S-K. Please also see the report of the Audit Committee set forth elsewhere in this Proxy Statement. The current Audit Committee charter is available for viewing on our website at ir.wavedancer.com/corporate-governance.

Compensation Committee

Our Compensation Committee met two times during 2022. This committee currently has two members, Jack L. Johnson (Chair) and Paul B. Becker. Our Compensation Committee reviews, approves and makes recommendations regarding our compensation policies, practices and procedures to ensure that legal and fiduciary responsibilities of the Board are carried out and that such policies, practices and procedures contribute to our success. The Compensation Committee has the authority and responsibility for determining and recommending the compensation of our Executive Officers and directors on the Board and must conduct its decision-making process with respect to that issue without the executive officers present. The Compensation Committee may consider the recommendations of executive officers when determining executive compensation. Our committee has not engaged paid compensation consultants to provide advice or recommendations in the last fiscal year. All members of the Compensation Committee qualify as independent under the definition promulgated by the NASDAQ Stock Market. The current Compensation Committee charter is available for viewing on our website at ir.wavedancer.com/corporate-governance.

Governance and Nominating Committee

Our Governance and Nominating Committee met two times during 2022. This committee currently has three members, James C. DiPaula (Chair), William H. Pickle, and Bonnie K. Wachtel. Our Governance and Nominating Committee carries out the responsibilities delegated by the Board relating to the Company’s director nominations process and procedures, developing and maintaining the Company’s corporate governance policies and any related matters required by the federal securities laws. All members of the Compensation Committee qualify as independent under the definition promulgated by the NASDAQ Stock Market. The current Governance and Nominating Committee charter is available for viewing on our website at ir.wavedancer.com/corporate-governance.

Attendance at Board and Stockholder Meetings

During our fiscal year ended December 31, 2022, our Board of Directors held five formal meetings, and each director attended at least 75% of the aggregate of (1) the total number of meetings of our Board of Directors held during the period for which he or she has been a director and (2) the total number of meetings held by all committees on which he or she served during the periods that he or she served.

Although we do not have a formal policy regarding attendance by members of our Board of Directors at the annual meetings of stockholders, we strongly encourage, but do not require, directors to attend.

Independence

We determine independence using the definitions set forth in the Nasdaq Listing Rules and the rules under the Securities Exchange Act of 1934. These definitions define independence based on whether the director or a family member of the director has been employed by the Company in the past three years, how much compensation the director or family member of a director received from the Company, how much stock the director or a family member of the director owns in the Company, and whether the director or a family member of the director is associated with the Company’s independent auditor.

Our Board has determined that the following members of the Board qualify as independent:

Paul B. Becker

James C. DiPaula, Jr.

Jack L. Johnson, Jr.

William H. Pickle

Bonnie K. Wachtel

There are no family relationships between any directors or executive officers of the Company.

Board Leadership Structure

The Board recognizes that the leadership structure and combination or separation of the Chief Executive Officer and Chairman roles is driven by the needs of the Company at any point in time. As a result, the Board does not have a fixed policy regarding the separation of the offices of Chief Executive Officer and Chairman and believes that it should maintain the flexibility to select the Chairman and its leadership structure, from time to time, based on the criteria that it deems in the best interests of the Company and its Stockholders. This has allowed the Board the flexibility to establish the most appropriate structure for the Company at any given time.

| WaveDancer, Inc. | 2023 Proxy Statement |

Currently, G. James Benoit, Jr. serves as Chairman and CEO, which the Board believes best serves the interest of the Company and its stockholders at this time. Although the Board does not have a “lead” independent director, each of the Board Committees is led by an independent director.

Board Role in Risk Oversight

Our Board receives regular communication from our management regarding areas of significant risk to us, including operational, strategic, legal and regulatory, and financial risks. Certain risks that are under the purview of a particular Committee are monitored by that Committee, which then reports to the full Board as appropriate.

Director Nominations

The Board of Directors nominates directors for election at each Annual Meeting of Stockholders and appoints new directors to fill vacancies when they arise. The Governance and Nominating Committee has the responsibility to identify, evaluate, recruit, and recommend qualified candidates to the Board for nomination or election.

One of the Board’s objectives in evaluating director nominations is to ensure that its membership is composed of experienced and dedicated individuals with a diversity of backgrounds, perspectives, and skills. The Governance and Nominating Committee will select nominees for director based on their character, judgment, diversity of experience, business acumen, and ability to act on behalf of all stockholders. We do not have a formal diversity policy. However, the Governance and Nominating Committee endeavors to have a Board representing diverse viewpoints as well as diverse expertise at policy-making levels in many areas, including business, accounting and finance, healthcare, manufacturing, marketing and sales, education, legal, government affairs, regulatory affairs, research and development, business development, international aspects of our business, technology, and in other areas that are relevant to our activities.