UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

(Rule 14a-101)

INFORMATION REQUIRED IN PROXY STATEMENT

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrant ☒

Filed by a Party other than the Registrant ☐

Check the appropriate box:

|

☐ |

Preliminary Proxy Statement |

|

☐ |

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

|

☒ |

Definitive Proxy Statement |

|

☐ |

Definitive Additional Materials |

|

☐ |

Soliciting Material under Rule 14a-12 |

INFORMATION ANALYSIS INCORPORATED

(Name of Registrant as Specified in its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

|

☒ |

No fee required. |

|

☐ |

Fee computed on table below per Exchange Act Rules 14a-6(i)(4) and 0-11 |

|

1. |

Title of each class of securities to which transaction applies: |

|

|

2. |

Aggregate number of securities to which transaction applies: |

|

| 3. | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): | |

|

4. |

Proposed maximum aggregate value of transaction: |

|

|

5. |

Total fee paid: |

|

|

☐ |

Fee paid previously with preliminary materials: |

|

☐ |

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

|

1. |

Amount Previously Paid: |

|

|

2. |

Form, Schedule or Registration Statement No.: |

|

|

3. |

Filing Party: |

|

|

4. |

Date Filed: |

|

October 27, 2021

Dear Shareholder,

We, the Board of Directors of Information Analysis Incorporated, cordially invite you to attend our 2021 annual meeting of shareholders to be held at 10:00 AM on December 2, 2021, at our offices at Suite 210, 12015 Lee Jackson Memorial Highway, Fairfax, Virginia 22033. The attached notice of annual meeting and proxy statement describe the business we will conduct at the meeting and provide information about Information Analysis Incorporated that you should consider when you vote your shares.

When you have finished reading the proxy statement, please promptly vote your shares. We encourage you to vote by proxy so that your shares will be represented and voted at the meeting, whether or not you can attend.

|

|

Sincerely, |

|

|

|

|

|

|

|

|

|

| G. James Benoit, Jr. | ||

|

|

Chief Executive Officer and Chairman |

|

October 27, 2021

NOTICE OF 2021 ANNUAL MEETING OF SHAREHOLDERS

| TIME: | 10:00 AM | |

| DATE: | December 2, 2021 | |

| PLACE: | Information Analysis Incorporated | |

| 12015 Lee Jackson Memorial Highway, Suite 210 | ||

| Fairfax, Virginia 22033 |

| PURPOSES: |

|

1. |

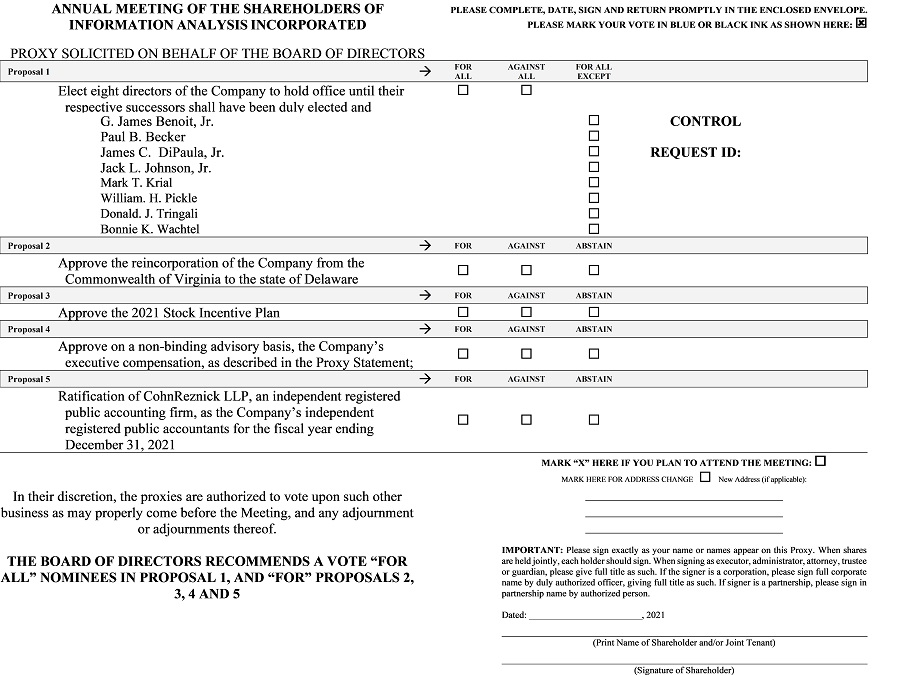

The election of eight (8) directors to serve until the next Annual Meeting of Shareholders and until their successors are elected and qualified. |

|

2. |

To approve the reincorporation of the Company from the Commonwealth of Virginia to the state of Delaware. |

|

3. |

To approve the adoption of the 2021 Stock Incentive Plan. |

|

4. |

To have an advisory vote to approve the Company’s executive compensation for Named Executive Officers. |

|

5. |

To ratify the appointment of CohnReznick LLP an independent registered public accounting firm, as the company’s independent registered public accountants for the fiscal year ending December 31, 2021. |

|

6. |

To consider any other business that is properly presented at the meeting. |

| WHO MAY VOTE: | |

| You may vote if you were the record owner of Information Analysis Incorporated stock at the close of business on October 4, 2021. A list of shareholders of record will be available at the meeting and, during the ten (10) days prior to the meeting, at the office of the Secretary at the above address. |

|

|

BY ORDER OF THE BOARD OF DIRECTORS |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Matthew T. Sands |

|

| Secretary |

|

YOUR VOTE IS VERY IMPORTANT |

|

Whether or not you plan to attend the Annual Meeting, please vote as soon as possible. You may vote over the Internet, as well as by telephone or, if you requested to receive printed proxy materials, by mailing a completed proxy card. |

| Information Analysis Incorporated | 2021 Proxy Statement |

INFORMATION ANALYSIS INCORPORATED

12015 Lee Jackson Memorial Highway, Suite 210

Fairfax, Virginia 22033

PROXY STATEMENT

For the 2021 ANNUAL MEETING OF SHAREHOLDERS

To be held on December 2, 2021

INFORMATION ABOUT THE MEETING, VOTING AND PROXIES

Date, Time and Place of Meeting

This proxy statement is furnished in connection with the solicitation of proxies by and on behalf of the Board of Directors ("Board") of Information Analysis Incorporated ("we," "IAI" or the "Company") for use at the 2021 Annual Meeting of Shareholders ("Annual Meeting") to be held on December 2, 2021 beginning at 10:00 am EDT at our principal executive offices located at 12015 Lee Jackson Memorial Highway, Suite 201, Fairfax, Virginia 22033, and at any adjournment or postponement of that meeting. On or about October 27, 2021, we are either mailing or providing notice and electronic delivery of these proxy materials together with an annual report, consisting of our Annual Report on Form 10-K for the fiscal year ended December 31, 2020 (the "2020 Annual Report"), and other information required by the rules of the Securities and Exchange Commission (the “SEC”).

Important Notice Regarding the Availability of Proxy Materials for the Annual Meeting of Shareholders to be held on December 2, 2021

This proxy statement and our 2020 Annual Report are available for viewing, printing and downloading at www.infoa.com/investors.

You may request a copy of the materials relating to our annual meetings, including the proxy statement and form of proxy for our 2021 Annual Meeting and the 2020 Annual Report, at www.infoa.com/investors, by sending an email to our Investor Relations department at investor@infoa.com, or by calling (703) 383-3000 ext. 7901.

Internet Availability of Proxy Materials

Under the U.S. Securities and Exchange Commission’s “notice and access” rules, we have elected to use the Internet as our primary means of furnishing proxy materials to our shareholders. Consequently, most shareholders will not receive paper copies of our proxy materials. We instead sent these shareholders a Notice of Internet Availability of Proxy Materials (“Internet Availability Notice”) containing instructions on how to access this Proxy Statement and our Annual Report and vote via the Internet. The Internet Availability Notice also included instructions on how to receive a paper copy of your proxy materials, if you so choose. If you received your annual meeting materials by mail, your proxy materials, including your proxy card, were enclosed. We believe that this process expedites shareholders’ receipt of proxy materials, lowers the costs of our Annual Meeting and helps to conserve natural resources.

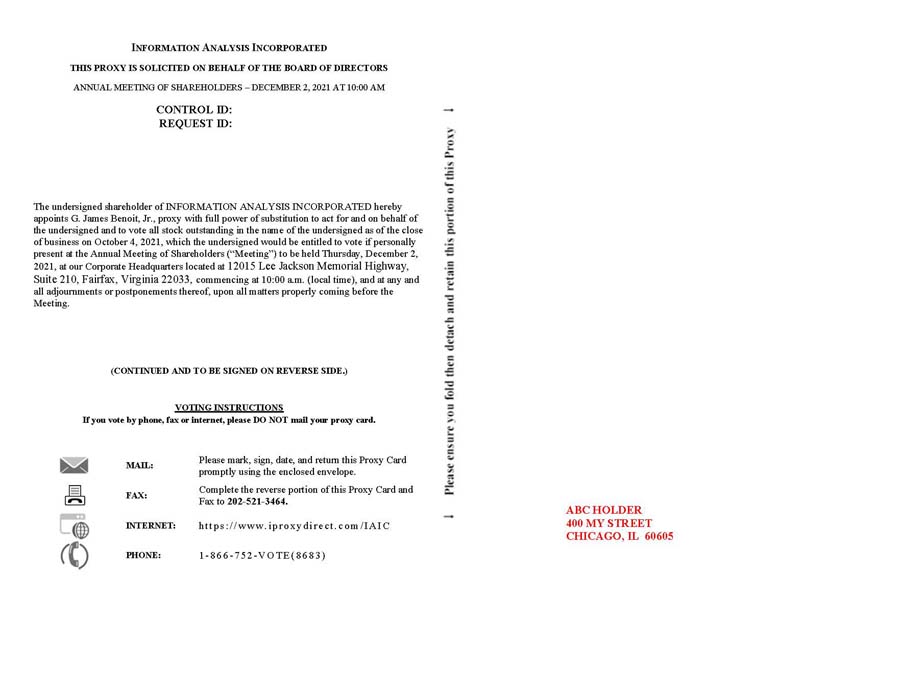

Voting Instructions

If your shares are registered directly in your name with our transfer agent, Issuer Direct, the Internet Availability Notice was sent directly to you by the Company. The Internet Availability Notice provides instructions on how to request printed proxy materials and how to access your proxy card which contains instructions on how to vote via the Internet or by telephone. For shareholders who receive a paper proxy card, instructions for voting via the Internet or by telephone are set forth on the proxy card. The Internet and telephone voting facilities for shareholders of record will close at 12:00 a.m. EDT on December 2, 2021. If your shares are held in an account at a brokerage firm, bank, trust or other similar organization, like the vast majority of our shareholders, you are considered the “beneficial owner” of shares held in “street name” and the Internet Availability Notice was forwarded to you by that organization. You will receive instructions from your broker, bank, trustee or other nominee that must be followed in order for your broker, bank, trustee or other nominee to vote your shares per your instructions. See the section below entitled “Abstentions and Broker Non-Votes” for additional information regarding the impact of abstentions and broker-non votes on the votes required for each proposal.

| Information Analysis Incorporated | 2021 Proxy Statement |

Revocability of Proxies

A holder of our common stock who has given a proxy may revoke it prior to its exercise either by giving written notice of revocation to the Secretary of the Company or by giving a duly executed proxy bearing a later date. Attendance in person at the Annual Meeting does not itself revoke a proxy; however, any shareholder who attends the Annual Meeting may revoke a previously submitted proxy by voting in person. If you are a beneficial owner of our shares, you will need to contact your bank, brokerage firm, trustee or other nominee to revoke any prior voting instructions.

Proxy Voting

Subject to any revocation as described above, all common stock represented by properly executed proxies will be voted in accordance with the specifications on the proxy. If no such specifications are made, proxies will be voted as follows:

|

● |

“FOR” the election of the eight nominees for director; |

|

● |

“FOR” the approval of the reincorporation of the Company from the Commonwealth of Virginia to the state of Delaware (the “Reincorporation”); |

|

● |

“FOR” the adoption of the 2021 Stock Incentive Plan (the “Amendment”). |

|

● |

“FOR” the approval, on an advisory basis, of the Company’s executive compensation for Named Executive Officers; |

|

● |

“FOR” ratification of the appointment of CohnReznick LLP as our independent registered public accountants for our fiscal year ending December 31, 2021; |

As to any other matter that may be brought before the Annual Meeting, proxies will be voted in accordance with the judgment of the person or persons voting the same.

Record Date, Outstanding Shares and Quorum

Only holders of our common stock of record at the close of business on October 4, 2021 (the “Record Date”) are entitled to notice of and to vote at the Annual Meeting. At the close of business on the Record Date, there were 13,510,690 shares of our common stock issued and outstanding. Shares of common stock held as treasury stock are not entitled to be voted at the Annual Meeting. Each shareholder is entitled to one vote per share of common stock held on all matters to be voted on by our shareholders. The presence in person or by proxy at the Annual Meeting of the holders of a majority of the issued and outstanding shares entitled to vote at the Annual Meeting shall constitute a quorum.

Proxy Solicitation

The Company will bear the expense of this solicitation of proxies, including the preparation, assembly, printing and mailing of the Internet Availability Notice, this Proxy Statement, the proxy and any additional solicitation material that the Company may provide to shareholders. Copies of the proxy materials and any other solicitation materials will be provided to brokerage firms, banks, fiduciaries and custodians holding shares in their names that are beneficially owned by others so that they may forward the solicitation material to such beneficial owners. We will reimburse such brokerage firms, banks, fiduciaries and other custodians for the reasonable out-of-pocket expenses incurred by them in connection with forwarding the proxy materials and any other solicitation materials. We have retained Issuer Direct Corporation to assist us with the distribution of proxies. The original solicitation of proxies by mail may be supplemented by solicitation by telephone and other means by directors, officers and employees of the Company. No additional compensation will be paid to these individuals for any such services.

Abstentions and Broker Non-Votes

Abstentions will be counted for purposes of determining the presence or absence of a quorum. The effect of an abstention on the outcome of the voting on a particular proposal depends on the vote required to approve that proposal, as described in the “Vote Required” section below.

| Information Analysis Incorporated | 2021 Proxy Statement |

“Broker non-votes” are shares present by proxy at the Annual Meeting and held by brokers or nominees as to which (i) instructions to vote have not been received from the beneficial owners and (ii) the broker or nominee does not have discretionary voting power on a particular matter. If you are a beneficial owner of shares held in “street name” and you do not provide voting instructions to your broker, your shares may be voted on any matter your broker has discretionary authority to vote. Under the rules that govern brokers who are voting with respect to shares held in “street name,” brokers generally have discretionary authority to vote on “routine” matters, but not on “non-routine” matters. The ratification of the appointment of an independent registered public accounting firm (the “independent auditor”) (Proposal 5) is considered a routine matter. Non-routine matters include the election of directors (Proposal 1), the reincorporation (Proposal 2), the adoption of the 2021 Stock Incentive Plan (Proposal 3), and the advisory vote on executive compensation (Proposal 4). We encourage you to provide instructions to your broker or other nominee regarding voting your shares. On any matter for which your broker or other nominee does not vote on your behalf, the shares will be treated as “broker non-votes”.

Broker non-votes will be counted for purposes of determining the presence or absence of a quorum for the transaction of business at the Annual Meeting. Broker non-votes will only have an effect on voting matters where the vote required is “a majority of the outstanding shares.” This vote requirement standard does not apply to Proposals 1, 3, 4 and 5 contained herein.

Board Voting Recommendations

Our Board recommends that you vote your shares FOR the election of each of the eight director nominees listed in Proposal 1 below; FOR the approval of the Reincorporation (Proposal 2), FOR the approval of the 2021 Stock Incentive Plan (Proposal 3 ), FOR the approval, on an advisory basis, of the Company’s executive compensation for Named Executive Officers (Proposal 4); and FOR the ratification of CohnReznick LLP as our independent registered public accountants for the fiscal year ending December 31, 2021 (Proposal 5).

Vote Required

Election of a director (Proposal 1) requires the affirmative vote of the holders of a plurality of the shares present in person or represented by proxy at a meeting at which a quorum is present with each shareholder getting one vote per share for each person proposed for election. The persons receiving the greatest number of votes at the Annual Meeting shall be elected as directors. Since only affirmative votes count for this purpose, abstentions and broker non-votes will not affect the outcome of the voting on this proposal.

Approval of the Reincorporation (Proposal 2) requires the affirmative vote, either in person or represented by a proxy at the meeting, of the holders of a majority of the issued and outstanding shares with each shareholder getting one vote per share.

Approval of the adoption of the 2021 Stock Incentive Plan (Proposal 3) requires the affirmative vote of a majority of the shares present in person or represented by proxy at a meeting at which a quorum is present with each shareholder getting one vote per share.

Although the vote for Proposal 4 is non-binding, the Board and the Compensation Committee will review the voting results. To the extent there is any significant negative vote, we would consult directly with shareholders to better understand the concerns that influenced the vote. The Board and the Compensation Committee would consider constructive feedback obtained through this process in making future decisions about executive compensation programs.

With respect to Proposal 5, the ratification of the appointment of our independent registered public accounting firm (the “independent auditor”) for the fiscal year ending December 31, 2021, a shareholder may mark the accompanying form of proxy card to (i) vote for the matter, (ii) vote against the matter, or (iii) abstain from voting on the matter.

Because only a majority of shares actually voting is required to approve Proposals 1, 3, 4 and 5, abstentions and broker non-votes will have no effect on the outcome of the voting on any of these proposals.

The inspector of election appointed for the Annual Meeting will separately tabulate affirmative and negative votes, abstentions and broker non-votes.

| Information Analysis Incorporated | 2021 Proxy Statement |

Voting Results

We will announce the preliminary voting results at the conclusion of the Annual Meeting. The final voting results will be tallied by the inspector of election and published in a Current Report on Form 8-K to be filed with the Securities and Exchange Commission within four (4) business days following the Annual Meeting.

Our Board encourages shareholders to attend the Annual Meeting. Whether or not you plan to attend, you are urged to submit your proxy. Prompt response will greatly facilitate arrangements for the meeting and your cooperation will be appreciated. Shareholders who attend the Annual Meeting may vote their stock personally even though they have sent in their proxies.

| Information Analysis Incorporated | 2021 Proxy Statement |

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

The following table sets forth the beneficial ownership of our common stock held as of October 4, 2021 by each person who is known by us based on Schedule 13G, Schedule 13D, and Section 16(a) filings to beneficially own more than 5% of the outstanding shares of our common stock, and as of October 4, 2021 by (1) each current director and nominee for director; (2) each of the named executive officers listed in the Summary Compensation Table included elsewhere in this proxy statement; and (3) by all current directors and executive officers as a group:

|

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS |

|||

|

TITLE OF CLASS: INFORMATION ANALYSIS INCORPORATED COMMON STOCK |

|||

|

Name and Address of Beneficial Owner |

Amount and Nature of Beneficial Ownership |

Percent Of Class |

|

|

Joseph P. Daly |

1,670,500(1) |

12.36 |

|

|

Alan Gelband |

1,059,397(2) |

7.84 |

|

|

Palm Management (US) LLC |

1,050,000(3) |

7.77 |

|

|

Traditions LP |

1,000,000(4) |

7.40 |

|

|

SECURITY OWNERSHIP OF MANAGEMENT |

|||

|

TITLE OF CLASS: INFORMATION ANALYSIS INCORPORATED COMMON STOCK |

|||

|

Name of Beneficial Owner (5) |

Amount and Nature of Beneficial Ownership |

Percent Of Class |

|

|

G. James Benoit, Jr. |

1,500,000 |

(6) |

11.1 |

|

Tim Hannon |

- |

* |

|

|

Stan A. Reese |

558,000 |

(7) |

4.0 |

|

Paul B. Becker (Nominee) |

- |

* |

|

|

James C. Di Paula, Jr. (Nominee) |

- |

* |

|

|

Jack L. Johnson, Jr. |

90,000 |

(8) |

* |

|

Mark T. Krial |

180,000 |

(9) |

1.3 |

|

Charles A. May, Jr. |

175,000 |

(10) |

1.3 |

|

William Pickle |

200,000 |

(11) |

1.5 |

|

Sandor Rosenberg |

95,290 |

(12) |

* |

|

Matthew T. Sands |

210,000 |

(13) |

1.5 |

|

Donald J. Tringali |

50,000 |

(14) |

* |

|

Bonnie K. Wachtel |

343,800 |

(15) |

2.5 |

|

All directors and executive officers as a group |

3,402,090 |

(16) |

23.8 |

| * | Less than 1% of ownership class. |

|

(1) |

The address of Joseph P. Daly is 497 Circle Freeway, Cincinnati, OH 45246. This information was obtained solely from a Form 4 filed by Mr. Daly on July 25, 2019. Mr. Daly owns 450,000 shares directly and 1,220,500 through EssigPR Inc.. |

|

(2) |

This information was obtained from a Schedule 13G filed with the SEC on February 2, 2021, and records from the Company’s private placement of August 26, 2021. The address of the filers is 62 Longwoods Lane, East Hampton, NY 11937. Shares beneficially owned include 378,847 shares with sole voting and sole dispositive power by Alan Gelband, 230,000 shares with sole voting and sole dispositive power by The Alan Gelband Company Defined Contribution Pension Plan and Trust (which includes 62,500 shares issuable upon exercise of warrants to purchase common stock), 440,550 shares with sole voting and sole dispositive power by Alan Gelband Roth IRA, and 10,000 shares with sole voting and sole dispositive power by The Alden Foundation. |

|

(3) |

This information was obtained solely from a Schedule 13G filed with the SEC jointly by Palm Management (US) LLC, Palm Global Small Cap Master Fund LP, Bradley C. Palmer, and Joshua Horowitz on February 17, 2021. The address of Palm Management (US) LLC is 19 West Elm Street, Greenwich, CT 06830. Total shares beneficially owned include 1,050,000 with shared voting power and 1,050,000 with shared dispositive power. |

|

(4) |

The address of record of Traditions LP is 924 Ridge Drive, McLean, VA 22101. |

|

(5) |

The address of record for all directors and executive officers is care of the Company at 12015 Lee Jackson Memorial Hwy, Ste 210, Fairfax VA 22033. |

|

(6) |

Includes 750,000 shares issuable upon the exercise of warrants to purchase common stock. |

|

(7) |

Includes 525,000 shares issuable upon the exercise of options and 10,000 shares issuable upon the exercise of warrants to purchase common stock. |

|

(8) |

Includes 35,000 shares issuable upon the exercise of warrants to purchase common stock. |

| Information Analysis Incorporated | 2021 Proxy Statement |

|

(9) |

Includes 10,000 shares issuable upon the exercise of options and 50,000 shares issuable upon the exercise of warrants to purchase common stock. |

|

(10) |

Includes 25,000 shares issuable upon the exercise of options and 40,000 shares issuable upon the exercise of warrants to purchase common stock. |

|

(11) |

Includes 20,000 shares issuable upon the exercise of options and 65,000 shares issuable upon the exercise of warrants to purchase common stock. |

|

(12) |

Mr. Rosenberg was Chief Executive Officer through his retirement effective December 31, 2020, and was a director through March 10, 2021. |

|

(13) |

Mr. Sands was Acting Principal Financial Officer effective April 20, 2020, and Chief Financial Officer from February 4 through September 29,2021. |

|

(14) |

Includes 25,000 shares issuable upon the exercise of warrants to purchase common stock. |

|

(15) |

Includes 40,000 shares issuable upon the exercise of options and 25,000 shares issuable upon the exercise of warrants to purchase common stock. |

|

(16) |

Includes 772,000 shares issuable upon the exercise of options and 1,000,000 shares issuable upon the exercise of warrants to purchase common stock. |

| Information Analysis Incorporated | 2021 Proxy Statement |

MANAGEMENT

The Board of Directors

Our Bylaws provide that our business is to be managed by or under the direction of our Board of Directors. All Directors are elected at each annual meeting of shareholders to serve until the next annual meeting of shareholders and until their successors have been elected and qualified. Our Board of Directors currently consists of eight (8) members.

Our Board of Directors voted to nominate Paul B. Becker, G. James Benoit, Jr., James C. DiPaula, Jr., Jack L. Johnson, Jr., Mark T. Krial, William H. Pickle, Donald J. Tringali, and Bonnie K. Wachtel for election at the annual meeting to serve until the 2022 Annual Meeting of Shareholders, and until their respective successors have been elected and qualified.

Set forth below are the names of the persons nominated as directors, their ages, their offices in the Company, if any, their principal occupations or employment for the past five (5) years, the length of their tenure as directors and the names of other public companies in which such persons hold directorships.

|

Name of Nominee |

Age |

Director Since |

Position with the Company |

|

Paul B. Becker |

60 |

- |

Director Nominee |

|

G. James Benoit, Jr. |

50 |

2021 |

Director, CEO and Chairman |

|

James C. DiPaula, Jr. |

59 |

- |

Director Nominee |

|

Jack L. Johnson, Jr. |

64 |

2021 |

Director |

|

Mark T. Krial |

64 |

2016 |

Director |

|

William H. Pickle |

71 |

2015 |

Director |

|

Donald J. Tringali |

63 |

2021 |

Director |

|

Bonnie K. Wachtel |

66 |

1992 |

Director |

Paul B. Becker, Rear Admiral, USN (ret), age 60, is a former Naval Intelligence Officer and senior executive with a unique combination of business, military, cyber and leadership experience. As the CEO of “The Becker T3 Group” consultancy he founded in 2016, he leverages an outstanding network of U.S. and international security leaders to provide clients with an understanding of National Security trends and activities. He’s successfully developed and implemented all-source intelligence strategies for large, diverse international teams. From 2016-17, Paul led the Presidential Transition’s Intelligence Community Landing Team which provided policy input, strategic guidance and operational counsel to a new administration. He served as Director of Intelligence for the Joint Chiefs of Staff beginning in 2013. Additional military service includes Director of Intelligence for the U.S. Pacific Command in Hawaii and the International Security Assistance Force Joint Command in Afghanistan, commanding officer of CENTCOM’s Joint Intelligence Center in Tampa, and Assistant Naval Attaché to France.

Rear Admiral Becker is the recipient of the National Intelligence Community and Department of Defense’s Distinguished Service Medals, and the Ellis Island Medal of Honor. The Naval Intelligence Community recognized RADM Becker in 2016 by establishing the “Teamwork, Tone, Tenacity” leadership award in his honor. He holds a Master’s degree in Public Administration from Harvard's Kennedy School of Government and a Bachelor of Science from the U.S. Naval Academy. A dynamic public speaker and author, his articles and presentations have been widely published.

G. James Benoit, Jr. age 50, has spent his career devoted to the intelligence and national security missions of the United States. From 2009 to 2019, he served as the CEO of FedData and Domain5, a pair of technology companies supplying secure hardware, engineering, analytics, network engineering and computer network operations support services to the National Intelligence Community and the Department of Defense. On his watch, FedData grew from start-up to nearly $500 million in revenue and over $30 million in earnings.

| Information Analysis Incorporated | 2021 Proxy Statement |

In 2015, Mr. Benoit led FedData through the acquisition of a distressed asset and successfully turned the asset around. He sold FedData in 2018, earning the stockholders and private equity partners an IRR greater than 80%. As CEO, Mr. Benoit secured over $300 million in asset-based credit facilities, $40 million in revolving facilities and over $75 million in senior unsecured debt. Mr. Benoit most recently led the FedData through the successful capture of a 5-year, more than $500 million, contract supporting the intelligence community. Mr. Benoit retired as CEO of FedData in December 2019.

Prior to becoming FedData’s CEO 10 years ago, Mr. Benoit’s career spanned distinguished service as an officer in the United States Army, important work in civilian government, and work in the private sector. A licensed attorney, he spent several years at prominent law firms where he worked on a range of matters including corporate formation, mergers and acquisitions, securities, leveraged buyouts, banking and finance.

Mr. Benoit is a graduate of St. Mary’s College of Maryland, the University of Baltimore and the Georgetown University Law Center. A lifelong resident of Annapolis, he lives with his wife and three children.

James C. “Chip” DiPaula, Jr., age 59, is Co-President of the Digital Commerce Division of Ascential plc., where he leads eight industry-leading brands, with 1,400 colleagues in the US, Canada, Europe, China and Latin America. Under Mr. DiPaula’s leadership the division acquired five businesses from December 2020 through September 2021.

Mr. DiPaula is Co-Founder of Flywheel Digital, a pioneering digital advertising firm that optimizes ecommerce sales for the world’s largest brands. Flywheel is Amazon’s largest advertising customer, representing leading consumer product groups including the world’s largest advertiser. Flywheel was acquired in 2018 by Ascential, plc. Mr. DiPaula also serves as Chairman of the University System of Maryland Medical System, with more than 25,000 employees and more than $4 billion in annual revenue. He chairs the System’s Executive and Executive Compensation Committees and serves on the Audit & Compliance and Governance and Nominating Committees. Mr. DiPaula’s public sector experience includes serving as Chief of Staff to the Governor of Maryland from 2005 to 2007, and serving as the youngest Secretary of the Maryland Department of Budget & Management in state history from 2003 to 2005. In this capacity, he oversaw development of a $26 billion state budget and resolved $4 billion in budget deficits through performance-based budgeting.

Mr. DiPaula received his Bachelor of Science degree in Business Administration from Towson University.

Jack L. Johnson, Jr., 64, is the CEO and Managing Partner for Jack Johnson and Associates, a strategic consulting firm located in McLean, VA. The firm specializes in providing business and risk consulting to clients domestically and internationally, particularly in the areas of business risk, pre and post-sale merger and acquisition support, business integration as well as in-depth security assessments.

Previously he was a Partner and Sector Leader with Guidehouse Consulting, and its legacy firm, PricewaterhouseCoopers (PwC), where he led the firm’s large Defense Sector Practice after previously serving as Sector Leader for its Homeland Security and Law Enforcement sector. Before joining PwC in 2005, Mr. Johnson served as the first Chief Security Officer (CSO) for the newly formed Department of Homeland Security (DHS). In this capacity, he was directly involved in the establishment of DHS after 9/11 and integrating the 22 agencies that now comprise the Department. His previous government service before his appointment at DHS consisted of over 20 years with the United States Secret Service, rising to the position of Deputy Assistant Director, and serving in a wide range of managerial and executive assignments of increasing responsibility and complexity. His career included the full range of investigative, protective, and intelligence-related duties, both domestically and internationally, as well as assignments with various Presidents, Vice Presidents, Presidential candidates, and foreign heads of state. Prior to being commissioned as a Secret Service Agent in 1983, he was a Police Officer and Detective for Fairfax County, Virginia Police Department, and also is a veteran of the United States Army.

Mr. Johnson received his Bachelor of Science degree from the University of Maryland, a Master’s in Forensic Science degree from George Washington University and has completed additional post-graduate study at the University of Virginia and Johns Hopkins School of Management. He has previously testified on multiple occasions before Congress on homeland security and national security-related issues and is a frequent speaker at many national and international conferences, seminars, and symposiums.

| Information Analysis Incorporated | 2021 Proxy Statement |

Mark T. Krial, 64, has been serving as president of Marathon TS, Inc., an information technology and professional services company which serves the federal government and commercial markets, since 2009. Prior to that, he served as president of Cornell Technical Services, an information technology firm, for 15 years. He holds a B.S. degree from Oklahoma A&M State University. Mr. Krial has been a board member of IAI since 2016.

Mr. Krial offers over 30 years of achievement within information technology and computer-based disciplines. His management approach emphasizes innovative techniques to achieve high performance, cost effective and profit enhancing solutions. High level experience includes sales, marketing, business development and strategic planning capabilities.

William H. Pickle, 71, is a government affairs/business development consultant with over 30 years of experience at senior levels within the federal government. Since 2007, Mr. Pickle has served as President of The Pickle Group, LLC, a Washington DC-based business development company. Mr. Pickle served as the 37th Sergeant at Arms (SAA) of the United States Senate. Mr. Pickle was nominated for this senior position by Senate Majority Leader Bill Frist and elected by the Senate in March 2003. He was re-elected in January 2005. In this position, Mr. Pickle served as the Senate's Chief Operating Officer, Chief of Protocol, Chief of Security; and managed over 950 Senate employees and an annual budget exceeding $200 million. As SAA, Mr. Pickle worked closely with Senators, Committees and senior Senate staff on a daily basis. In addition, as the SAA, he served as Chairman of the U.S. Capitol Police Board with direct oversight for a 2200 person police department with a budget of $300 million. Prior to his Senate service, Mr. Pickle served in several Senior Executive Service (SES) positions within the Executive Branch, which included being the first SES Director of the Transportation Security Administration and a Deputy Inspector General of the Department of Labor.

Most of Mr. Pickle's career was spent with the United States Secret Service where he rose steadily through the ranks from Special Agent to Senior Executive. Mr. Pickle served as Executive Assistant Director responsible for the Congressional and Legislative Affairs program of the Secret Service from 1991 to 1998.

Mr. Pickle is a decorated Vietnam Veteran who served with the 1st Cavalry Division in 1968-69. Among his awards are the Bronze Star, Purple Heart, 7 Air Medals (2 for valor), 3 Army Commendation Medals, Vietnamese Cross of Gallantry, and the Combat Infantry Badge. Mr. Pickle served on the President's Medal of Valor Award Committee and currently serves on numerous not-for-profit and corporate boards. He was a member of the 2004 Presidential Election Advisory Committee.

Donald J. Tringali, age 63, is the founder and current CEO of Augusta Advisory Group, a boutique financial and business consulting firm providing a full range of executive, operations and corporate advisory services to companies. He has held a variety of C-level executive positions and directorships for public and private companies across many industries. He is currently on the boards of Swiss Water Decaffeinated Coffee, Inc. (SWP.TO), POSaBIT Systems Corporation (PBIT.CN), and Paragon Space Development Corporation (private). He is the former Chairman of the Board of National Technical Systems, Inc. (NTSC), a leading international testing and engineering firm that was sold to a private equity firm in 2013, and the former Executive Chairman of the Board of Cartesian, Inc. (CRTN), an international telecom consulting company, which was sold to private equity in 2018. Mr. Tringali began his career as a corporate attorney in Los Angeles, where he was a partner in a prominent firm representing public and private companies in general business matters and M&A transactions. Mr. Tringali holds a BA in Economics from UCLA and a JD (Juris Doctor) degree from Harvard Law School.

Bonnie K. Wachtel, 66, is a principal of Wachtel & Co., Inc., a boutique investment firm based in Washington, D.C. Her career spans investment banking, valuation consulting, and oversight of financial reporting and internal controls. Ms. Wachtel has been a director of six Nasdaq-listed companies since joining her firm in 1984, and currently serves on the Board of VSE Corporation (VSEC), a provider of engineering services principally to federal government clients, and The ExOne Co. (XONE), a global provider of 3D printing machines, products, and services. Her securities industry experience includes service on the Advisory Committee for the National Market System Consolidated Audit Trail, LLC, an entity created by order of the SEC, and ten years on the Hearing Panel for Nasdaq Listing Qualifications. Ms. Wachtel holds B.A. and M.B.A. degrees from the University of Chicago and a J.D. from the University of Virginia. She is a Chartered Financial Analyst (CFA).

| Information Analysis Incorporated | 2021 Proxy Statement |

Ms. Wachtel is a trusted resource with regard to business strategy, public markets, merger and acquisition opportunities, corporate governance, regulatory compliance, and risk management. Given her background and occupation, she is qualified to be the audit committee’s financial expert.

Independence

Our Board has determined that with the exception of Messrs. Benoit and Reese, all the members of the Board qualify as independent under the definition promulgated by the NASDAQ Stock Market:

There are no family relationships between any directors or executive officers of the Company.

Board Leadership Structure

IAI does not have a policy on whether the offices of Chairman of the Board and Chief Executive Officer (“CEO”) should be separate. Currently, G. James Benoit, Jr. serves as CEO and Chairman. Although the Board does not have a “lead” independent director, all of the Board’s committees – Audit, Compensation, and Corporate Governance and Nominations – are led by independent directors.

Board Role in Risk Oversight

Our Board receives regular communication from our management regarding areas of significant risk to us, including operational, strategic, legal and regulatory, and financial risks. Certain risks that are under the purview of a particular Committee are monitored by that Committee, which then reports to the full Board as appropriate.

Committees of the Board of Directors and Meetings

Meeting Attendance. During the fiscal year ended December 31, 2020 there were four meetings of our Board of Directors. All directors attended all of the meetings of the Board and of committees of the Board on which he or she served during 2020 except for Mr. Wester, who attended none. The Board undertook additional actions via unanimous consent. The Board has adopted a policy under which each member of the Board is strongly encouraged to attend each annual meeting of our shareholders.

Audit Committee. Our Audit Committee met one time during 2020, and the Chair met with our outside auditors on a quarterly basis. During 2020 this committee had two members, Bonnie K. Wachtel (Chair) and Charles A. May, Jr.. Our Audit Committee has the authority to retain and terminate the services of our independent registered public accountants, reviews annual financial statements, considers matters relating to accounting policy and internal controls and reviews the scope of annual audits. All members of the Audit Committee satisfy the current independence standards promulgated by the SEC and by the NASDAQ Stock Market; as such standards apply specifically to members of audit committees. The Board has determined that Ms. Wachtel is our “audit committee financial expert,” as the SEC has defined that term in Item 407 of Regulation S-K. Please also see the report of the Audit Committee set forth elsewhere in this proxy statement. The current audit committee charter is available for viewing on our Web site at www.infoa.com on the Investors page under the Investor Relations heading. Effective as of October 11, 2021, our audit committee was comprised of Ms. Wachtel, as Chair, Mr. May and Mr. Tringali.

Compensation Committee. Our Compensation Committee met four times during 2020. Throughout 2020, this committee had four members, Ms. Wachtel (Chair), Mr. Krial, Mr. May, and Mr. Pickle. Mr. Johnson was added upon his joining the Board in March 2021. This committee commenced operating under a charter on October 8, 2021 which can be found on our website. Effective on October 11, 2021, the Board appointed Mr. Johnson to serve as Chair and appointed Mr. Krial and Mr. Becker to serve on the committee. Our Compensation Committee reviews, approves and makes recommendations regarding our compensation policies, practices and procedures to ensure that legal and fiduciary responsibilities of the Board of Directors are carried out and that such policies, practices and procedures contribute to our success. The Compensation Committee has the authority and responsibility for determining and recommending the compensation of our Executive Officers and shall conduct its decision-making process with respect to that issue without the executive officers present. The Compensation Committee may consider the recommendations of executive officers when determining executive compensation. Our committee has not engaged paid compensation consultants to provide advice or recommendations in the last fiscal year. All members of the Compensation Committee qualify as independent under the definition promulgated by the NASDAQ Stock Market.

| Information Analysis Incorporated | 2021 Proxy Statement |

Governance and Nominating Committee. On October 8, 2021, we established a governance and nominating committee and adopted a charter for this committee which can be found on our website. This committee has six members, Mr. Tringali (Chair), Mr. Johnson, Mr. Krial, Mr. May, Mr. Pickle, and Ms. Wachtel. This committee’s functions include making recommendations as to the size and composition of the Board and its committees and to evaluate and make recommendations as to potential candidates. All members of the Board, apart from Messrs. Benoit and Reese, qualify as independent under the definition promulgated by the NASDAQ Stock Market. The Board may consider candidates recommended by shareholders as well as from other sources such as directors or officers, third party search firms or other appropriate sources. For all potential candidates, the Board may consider all factors it deems relevant, such as a candidate’s personal integrity and sound judgment, business and professional skills and experience, independence, knowledge of the industry in which we operate, possible conflicts of interest, diversity, the extent to which the candidate would fill a present need on the Board, and concern for the long-term interests of the shareholders. In general, persons recommended by shareholders will be considered on the same basis as candidates from other sources. If a shareholder wishes to nominate a candidate to be considered for election as a director at the 2022 Annual Meeting of Shareholders, it must follow the procedures described in “Shareholder Proposals and Nominations for Director.”

Shareholder Communications to the Board

Generally, shareholders who have questions or concerns should contact our Investor Relations department at (703) 383-3000. However, any shareholders who wish to address questions regarding our business directly with the Board of Directors, or any individual director, should direct his or her questions in writing to:

Board of Directors of Information Analysis Incorporated

ATTN: G. James Benoit, Jr. Chairman of the Board

12015 Lee Jackson Memorial Highway, Suite 210

Fairfax, Virginia 22033

Shareholder communications addressed to the Board, but not addressed to a specific Board member, will be relayed to the Chairman of the Board, and from there will be distributed to the Chairperson of the committee that oversees the subject matter of the communication.

| Information Analysis Incorporated | 2021 Proxy Statement |

Compensation of Directors

The Company pays each non-employee director an annual fee of $20,0001 to serve on the Board, payable quarterly. Options to purchase shares of common stock may be issued in addition to the director’s annual fee. Expenses incurred in attending Board of Director meetings and committee meetings may be reimbursed. The following Table describes all compensation for each director for the year ended December 31, 2020.

|

Director Compensation |

||||||||||||||||||||||||||||

|

Name (a) |

Fees Earned or Paid in Cash ($) (b) |

Stock Awards ($) (c) |

Option Awards ($) (d) |

Non-Stock Incentive plan compensation ($) (e) |

Nonqualified deferred compensation ($) (f) |

All Other Compensation ($) (g) |

Total ($) (h) |

|||||||||||||||||||||

|

Mark T. Krial |

2,000 | - | - | - | - | - | 2,000 | |||||||||||||||||||||

|

Charles A. May, Jr |

2,000 | - | - | - | - | - | 2,000 | |||||||||||||||||||||

|

William H. Pickle |

2,000 | - | - | - | - | - | 2,000 | |||||||||||||||||||||

|

Bonnie K. Wachtel |

2,000 | - | - | - | - | - | 2,000 | |||||||||||||||||||||

|

James D. Wester2 |

2,000 | - | - | - | - | - | 2,000 | |||||||||||||||||||||

1 Through December 31, 2020, compensation for non-employee Board members was $2,000 per annum. On March 31, 2021, the Board voted to raise its compensation for non-employee members to $20,000 per annum for regular members and $30,000 for a non-employee Chairman.

2Retired as a director effective March 10, 2021.

Executive Officers

The following table sets forth certain information regarding our executive officers who are not also directors.

|

Name |

Age |

Position |

|

Timothy G. Hannon |

57 |

Chief Financial Officer |

|

Stanley A. Reese |

65 |

President |

Timothy G. Hannon, age 57, joined the Company as Chief Financial Officer in September 2021. Since June 2021, Mr. Hannon has been a Managing Director at GlassRatner Advisory & Capital Group, LLC d/b/a B. Riley Advisory Services. From March 2017 until June 2021, Mr. Hannon served as VP Finance & Corporate Controller and then as Chief Financial Officer of Ready Pac Foods, Inc. (“RPF”) d/b/a Bonduelle Fresh Americas, a wholly owned subsidiary of Bonduelle SA, a French publicly traded company. From May 2016 to March 2017, Mr. Hannon was an outside consultant to RPF in connection with Bonduelle’s acquisition of RPF Prior thereto, Mr. Hannon was the chief financial officer for several privately held enterprises. He began his career with Arthur Andersen & Co. in New York where he was primarily assigned to audits of publicly traded companies. Mr. Hannon graduated from the State University of New York at Albany with a bachelor’s degree in accounting and is a certified public accountant

Stanley A. Reese, 64, joined the Company in 1993. Mr. Reese has been director since March 11, 2021, President since February 17, 2021, and served as Chief Executive Officer until August 26, 2021, after serving in interim capacities for those officer positions from January 1, 2021. He previously served as Senior Vice President beginning in 1997 and Chief Operating Officer beginning in 1999. From 1992 to 1993, he served as Vice President, Technical Services at Tomco Systems, Inc. Prior to Tomco Systems, he served as Senior Program manager at ICF Information Technology, Inc. Mr. Reese has over 35 years of experience managing and marketing large scale mainframe and PC-based applications. Mr. Reese holds a B.A. in History from George Mason University.

| Information Analysis Incorporated | 2021 Proxy Statement |

EXECUTIVE COMPENSATION

The Summary Compensation Table below sets forth individual compensation information for the Chief Executive Officer and the other executive officers serving as executive officers as of December 31, 2020 (collectively “Named Executive Officers”):

|

SUMMARY COMPENSATION TABLE |

|||||||||||||||||||||

|

Name and principal position |

Year |

Salary ($) |

Bonus ($) |

Option Awards ($) |

All Other Compensation1 ($) |

Total ($) |

|||||||||||||||

|

Sandor Rosenberg2 |

2020 |

142,000 | - | - | 32,654 | 174,654 | |||||||||||||||

|

Chairman of the Board and Chief Executive Officer through 12/31/2020 |

2019 |

142,000 | - | - | 15,335 | 157,335 | |||||||||||||||

|

Stanley A. Reese3 |

2020 |

161,875 | 10,000 | 37,000 | 21,977 | 230,852 | |||||||||||||||

|

Chief Operating Officer |

2019 |

154,000 | - | - | 9,662 | 163,662 | |||||||||||||||

|

Richard S. DeRose4 |

2020 |

20,417 | - | - | 850 | 21,267 | |||||||||||||||

|

Executive Vice President and Chief Financial Officer through 04/19/2020 |

2019 |

70,000 | - | - | 8,921 | 78,921 | |||||||||||||||

|

Matthew T. Sands Acting Chief Financial Officer from 04/20/2020 |

2020 |

141,500 | 5,000 | 37,000 | 7,351 | 190,851 | |||||||||||||||

1References to All Other Compensation include employer matching contributions to each individual’s 401(k) defined contribution account under our company-wide 401(k) Pension and Profit-Sharing Plan, routine payouts of excess vacation accruals, and employer payments for long-term care insurance under an executive carve-out.

2Mr. Rosenberg retired as CEO effective December 31, 2020.

3Mr. Reese was appointed Interim President and CEO effective January 1, 2021, and President and CEO effective February 17, 2021. On March 31, 2021, Mr. Reese’s salary was increased to $250,000 per annum retroactive to January 1, 2021.

4Due to illness, Mr. DeRose took a leave of absence effective April 29, 2020. He ultimately retired in 2021. Mr. Sands was appointed Acting Chief Financial Officer on April 20, 2020. On February 4, 2021, Mr. Sands was appointed Chief Financial Officer at a salary of $165,000.

Each named executive officer is a salaried employee, without any guaranteed incentives. Bonuses and option awards are at the discretion of the Compensation Committee of the Board of Directors. Executive officers are eligible to participate in the Information Analysis Incorporated 401(k) Pension and Profit-Sharing Plan under the same terms and matching percentages as other salaried employees. Vacation accruals in excess of defined limits are automatically paid out to all salaried employees annually, and may be paid other times upon request. Executive officers receive a perquisite benefit of no-cash-value long-term care insurance paid by the Company.

| Information Analysis Incorporated | 2021 Proxy Statement |

The following table sets forth the outstanding equity awards for the named executive officers of the Company as of December 31, 2020:

|

OUTSTANDING EQUITY AWARDS AT FISCAL YEAR-END |

||||

|

OPTION AWARDS |

||||

|

Name (a) |

Number of Securities Underlying Unexercised Options (#) Exercisable (b) |

Number of Securities Underlying Unexercised Options (#) Unexercisable (c) |

Option Exercise Price ($) (e) |

Option Expiration Date (f) |

|

Stanley A. Reese |

50,000 |

0.15 |

03/20/2022 |

|

|

Stanley A. Reese |

100,000 |

0.35 |

07/17/2022 |

|

|

Stanley A. Reese |

100,000 |

0.16 |

02/12/2023 |

|

|

Stanley A. Reese |

50,000 |

0.145 |

10/07/2023 |

|

|

Stanley A. Reese |

25,000 |

0.25 |

04/11/2026 |

|

|

Stanley A. Reese |

100,000 |

0.47 |

02/22/2028 |

|

|

Stanley A. Reese |

100,000 |

0.66 |

09/02/2030 |

|

|

Matthew T. Sands |

8,000 |

0.16 |

05/26/2021 |

|

|

Matthew T. Sands |

20,000 |

0.15 |

06/12/2022 |

|

|

Matthew T. Sands |

32,000 |

0.156 |

08/08/2023 |

|

|

Matthew T. Sands |

20,000 |

0.17 |

09/23/2024 |

|

|

Matthew T. Sands |

20,000 |

0.37 |

06/19/2028 |

|

|

Matthew T. Sands |

100,000 |

0.66 |

09/02/2030 |

|

The Company has no outstanding stock awards to any executive officer.

Equity Compensation Plan Information

The following table contains information regarding securities authorized and available for issuance under our equity compensation plans for certain employees, directors, and consultants, as of October 4, 2021.

|

Plan Category |

Number of securities to be issued upon exercise of outstanding options, warrants, and rights |

Weighted average exercise price of outstanding options, warrants, and rights |

Number of securities remaining available for future issuance |

|||||||||

|

Equity compensation plans approved by security holders1,2 |

1,227,500 | $ | 0.94 | 91,500 | ||||||||

|

Equity compensation plans not approved by security holders |

-- | -- | -- | |||||||||

|

Total |

1,227,500 | $ | 0.94 | 91,500 | ||||||||

1 The Company has a stock incentive plan, which became effective June 1, 2016, and expires April 4, 2026 (the “2016 Plan”). The 2016 Plan provides for the granting of equity awards to employees and directors. The maximum number of shares for which equity awards may be granted under the 2016 Plan is 1,000,000. Options granted under the 2016 Plan expire no later than ten years from the date of grant or 90 days after employment ceases, whichever comes first, and vest over periods determined by the Board of Directors.

2 The Company had a stock incentive plan, which became effective May 18, 2006, and expired April 12, 2016 (the “2006 Plan”). The 2006 Plan provided for the granting of equity awards to employees and directors. Options granted under the 2006 Plan expire no later than ten years from the date of grant or 90 days after employment ceases, whichever comes first, and vest over periods determined by the Board of Directors.

| Information Analysis Incorporated | 2021 Proxy Statement |

Employment Contracts, Termination of Employment and Change-in-Control Arrangements

On September 30, 1997, the Company agreed in writing to provide to Stanley A. Reese, currently serving as President, and having served as Chief Executive Officer and President as of February 17, 2021, and Senior Vice President and Chief Operating Officer prior to that, three months’ severance pay of his full-time base salary, payable in normal payroll increments, in the event of the termination of his employment other than for cause. In the event of a change of control or the sale or transfer of substantially all of the Company’s assets, the Company agreed that in the event of Mr. Reese’s termination or substantial reduction of duties, he will receive a six-month severance payment of base salary, payable in lump sum or monthly, at the Company’s discretion. Had the event of termination or change-in-control occurred on December 31, 2020, Mr. Reese’s compensation under the agreement would have been $43,750 or $87,500, respectively.

On September 2, 2020, the Company agreed in writing to provide to Matthew T. Sands, Chief Financial Officer as of February 17, 2021, and formerly Controller and acting Chief Financial Officer, three months’ severance pay of his full-time base salary, payable in normal payroll increments, in the event of the termination of his employment other than for cause. In the event of a change of control or the sale or transfer of substantially all of the Company’s assets, the Company agreed that in the event of Mr. Reese’s termination or substantial reduction of duties, he will receive a three-month severance payment of base salary, payable in lump sum or monthly, at the Company’s discretion. Had the event of termination or change-in-control occurred on December 31, 2020, Mr. Sands’ compensation under the agreement would have been $35,375.

Retirement Plans

The Company has a Cash or Deferred Arrangement Agreement, which satisfies the requirements of Section 401(k) of the Internal Revenue Code. This defined contribution retirement plan covers substantially all employees. Participants can elect to have up to the maximum percentage allowable of their salaries reduced and contributed to the plan. The Company may make matching contributions equal to a discretionary percentage of the participants’ elective deferrals. In 2020 and 2019, the Company matched 25% of the first 6% of the participants’ elective deferrals. The balance of funds forfeited by former employees from unvested employer matching contribution accounts may be used to offset current and future employer matching contributions. The Company may also make additional contributions to all eligible employees at its discretion. The Company did not make additional contributions during 2020 or 2019. Expenses for matching contributions for the years ended December 31, 2020 and 2019 were $40,741 and $32,162, respectively.

Changes in Registrant’s Certifying Accountant.

None.

Changes In and Disagreements With Accountants on Accounting and Financial Disclosure

There have been no changes in or disagreements with our independent registered public accountants on accounting and financial disclosure.

TRANSACTIONS WITH RELATED PERSONS

A "Related Party Transaction" is any transaction directly or indirectly involving any related party that would need to be disclosed under Item 404(a) of Regulation S-K. The Company has determined as a policy that any Related Party Transaction requires the approval by the Board of Directors.

For the year ended December 31, 2020, the Company determined that it had not engaged in related party transactions subject to reporting herein.

| Information Analysis Incorporated | 2021 Proxy Statement |

REPORT OF AUDIT COMMITTEE

The Audit Committee of the Board of Directors, which consists entirely of directors who meet the independence and experience requirements of the NASDAQ stock market, has furnished the following report:

The Audit Committee assists the Board in overseeing and monitoring the integrity of our financial reporting process, compliance with legal and regulatory requirements and the quality of internal and external audit processes. This committee’s role and responsibilities are set forth in our charter adopted by the Board. This committee reviews and reassesses our charter annually and recommends any changes to the Board for approval. The Audit Committee is responsible for overseeing our overall financial reporting process, and for the appointment, compensation, retention, and oversight of the work of CohnReznick LLP. In fulfilling its responsibilities for the financial statements for fiscal year December 31, 2020, the Audit Committee took the following actions:

● Reviewed and discussed the audited financial statements for the fiscal year ended December 31, 2020, with management and CohnReznick LLP, our independent auditors;

● Discussed with CohnReznick LLP the matters required to be discussed by Auditing Standard No. 1301 adopted by the Public Company Accounting Oversight Board (United States) regarding “Communication with Audit Committees.”; and

● Received and reviewed the written disclosures and the letter from CohnReznick LLP required by applicable requirements of the Public Company Accounting Oversight Board regarding the independent accountant’s communications with the audit committee concerning independence, and has discussed with CohnReznick LLP its independence.

Based on the Audit Committee’s review of the audited financial statements and discussions with management and CohnReznick LLP, the Audit Committee recommended to the Board that the audited financial statements be included in our Annual Report on Form 10-K for the year ended December 31, 2020, for filing with the SEC.

Members of the Information Analysis Incorporated Audit Committee

Bonnie K. Wachtel

Charles A. May, Jr.

SECTION 16(a) BENEFICIAL OWNERSHIP REPORTING COMPLIANCE

Section 16(a) (“Section 16(a)”) of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), requires executive officers and Directors and persons who beneficially own more than ten percent (10%) of the Company’s common stock to file initial reports of ownership and reports of changes in ownership with the SEC and any national securities exchange on which the Company’s securities are registered. Executive officers, Directors and greater than ten percent (10%) beneficial owners are required by the SEC’s regulations to furnish the Company with copies of all Section 16(a) forms they file.

Based solely on a review of the copies of such forms furnished to the Company, there were no officers, directors and 10% beneficial owners who failed to file on a timely basis the forms required under Section 16(a) of the Exchange Act.

| Information Analysis Incorporated | 2021 Proxy Statement |

PROPOSAL 1

ELECTION OF DIRECTORS

The Governance and Nominating Committee nominated G. James Benoit, Jr, Paul B. Becker, James C. DiPaula, Jr., Jack L. Johnson, Jr., Mark T. Krial, William H. Pickle, Donald J. Tringali, and Bonnie K. Wachtel for election at the Annual Meeting. If they are elected, and Proposal 2 is Approved, they will serve on our Board of Directors until the Annual Meeting of Shareholders in the year that corresponds to the Class schedule for each director below, and until their respective successors have been elected and qualified. If Proposal 2 is not Approved, they will serve on our Board of Directors until the 2022 Annual Meeting of Shareholders.

Unless authority to vote for any of these nominees is withheld, the shares represented by the enclosed proxy will be voted FOR the election as directors of G. James Benoit, Jr., Paul B. Becker, James C. DiPaula, Jr,, Jack L. Johnson, Jr., Mark T. Krial, William H. Pickle, Donald J. Tringali and Bonnie K. Wachtel, In the event that any nominee becomes unable or unwilling to serve, the shares represented by the enclosed proxy will be voted for the election of such other person as the Board of Directors may recommend in his/her place. We have no reason to believe that any nominee will be unable or unwilling to serve as a director.

All nominees are currently Directors of the Company and have served continuously since the dates of their elections or appointments as shown on page 7.

A plurality of the shares voted affirmatively or negatively at the Meeting is required to elect each nominee as a director.

If the shareholders approve Proposal 2 thereby creating a staggered board, the classes that each of the directors hold will be as follows:

Class I (expiring at the 2022 Annual Meeting) Mr. Krial, Ms. Wachtel

Class II (expiring at the 2023 Annual Meeting) Mr. Johnson, Mr. Pickle, Mr. Tringali

Class III (expiring at the 2024 Annual Meeting) Mr. Becker, Mr. Benoit, Mr. DiPaula

The Board Of Directors Recommends The Election Of G. James Benoit, Jr, Paul B. Becker, James C. DiPaula, Jr., Jack L. Johnson, Jr., Mark T. Krial, William H. Pickle, Donald J. Tringali and Bonnie K. Wachtel As Directors, And Proxies Solicited By The Board Will Be Voted In Favor Thereof Unless A Shareholder Has Indicated Otherwise On The Proxy.

| Information Analysis Incorporated | 2021 Proxy Statement |

PROPOSAL 2

APPROVAL OF REINCORPORATION OF THE COMPANY

FROM THE COMMONWEALTH OF VIRGINIA TO THE STATE OF DELAWARE

General

The Board has unanimously approved and recommends that shareholders approve the reincorporation of the Company from the Commonwealth of Virginia to the State of Delaware (the “Reincorporation” or the “Reincorporation Proposal”). This approval and recommendation have been provided by the entire Board. The Company would affect the Reincorporation pursuant to a plan of domestication in form attached hereto as Appendix 1 (the “Plan of Domestication”). As part of the Reincorporation, the name of the entity following the completion of the Reincorporation will be “WaveDancer, Inc.” (the “DE CORP”). Additionally, the authorized capital of the Company will be 100,000,000 shares of common stock and 1,000,000 shares of preferred stock, with the right of the Board to issue such shares pf preferred stock in one or more series, each with such rights and preferences as the Board determines. At the effective time of the domestication (the “Effective Time”), the Certificate of Incorporation in the form attached hereto as Appendix 2 (the “Delaware Certificate of Incorporation”), and the Bylaws in the form attached hereto Appendix 3 (the “Delaware Bylaws”), will govern the DE IAI. All descriptions of the Delaware Certificate of Incorporation and Delaware Bylaws are qualified by and subject to the more complete information set forth in those documents.

Upon the Effective Time:

|

(1) |

The affairs of the Company will cease to be governed by Virginia corporation laws and will become subject to Delaware corporation laws. See “Comparison of Shareholder Rights Before and After the Reincorporation” below. |

|

|

(2) |

The legal existence of the Company as a separate Virginia corporation will cease and DE CORP will continue with all of the rights, titles and interests of the Company, will continue with the same officers and directors of the Company, the rights of creditors of the Company will continue to exist as creditors of DE CORP, and the shareholders of the Company will be the stockholders of DE CORP. |

|

|

(3) |

Each outstanding share of our common stock of the Company will automatically be converted into one share of common stock, par value $0.01 per share, of DE CORP (“DE CORP Common Stock”). |

|

|

(4) |

Each outstanding option and warrant to purchase our common stock will automatically be converted into an option or warrant, as the case may be, to purchase an identical number of shares of DE CORP Common Stock at the same exercise price per share and upon the same terms and subject to the same conditions set forth in the applicable plan, related award agreement, option agreement, or warrant agreement, as applicable. |

|

|

|

The Delaware Certificate of Incorporation provides for a staggered Board of Directors. If the Reincorporation is approved, please see Proposal 1 for the respective classes to which each elected director will be assigned.

No regulatory approval (other than various filings with the State Corporation Commission of Virginia and the Secretary of State of Delaware discussed above) is required to effect the Reincorporation. The terms of the Reincorporation are described in more detail in the Plan of Domestication and all descriptions of the Reincorporation are qualified by and subject to the more complete information therein.

Reasons for the Reincorporation

The State of Delaware has been a leading jurisdiction in adopting a comprehensive and coherent set of corporate laws that are responsive to the evolving legal and business needs of corporations organized under Delaware law. Our Board believes that it is important for the Company to be able to draw upon well-established principles of corporate governance in making legal and business decisions. The prominence and predictability of Delaware corporate law provide a reliable foundation on which our governance decisions can be based, and we believe that our shareholders will benefit from the responsiveness of Delaware corporate law to their needs. In addition, the Board believes that direct benefits that Delaware law provides to a corporation indirectly benefit our shareholders, who are our owners. Specifically, our Board believes that there are several benefits of the Reincorporation, as summarized below.

| Information Analysis Incorporated | 2021 Proxy Statement |

Access to Specialized Courts

Delaware has a specialized court of equity called the Court of Chancery that hears corporate law cases. The Delaware Court of Chancery operates under rules that are intended to ensure litigation of disputes in a timely and effective way, keeping in mind the timelines and constraints of business decision-making and market dynamics. The appellate process on decisions emanating from the Court of Chancery is similarly streamlined, and the justices of Delaware appellate courts tend to have substantial experience with corporate cases because of the relatively higher volume of these cases in the Delaware courts. As the leading state of incorporation for both private and public companies, Delaware has developed a vast body of corporate law that helps to promote greater consistency and predictability in judicial rulings. In contrast, Virginia does not have a similar specialized court established to hear corporate law cases. Rather, disputes involving questions of Virginia corporate law are either heard in law courts of general jurisdiction, alongside other civil cases, or, if federal jurisdiction exists, a federal district court. These courts hear many different types of cases, and the cases may be heard before judges or juries with limited corporate law experience. As a result, corporate law cases brought in Virginia may not proceed as expeditiously as cases brought in Delaware and the outcomes in such courts may be less consistent and predictable.

Delaware has one of the most modern statutory corporation codes, which is revised regularly in response to changing legal and business needs of corporations. The Delaware legislature is particularly responsive to developments in modern corporate law and Delaware has proven sensitive to changing needs of corporations and their shareholders. The Delaware Secretary of State is viewed as particularly flexible and responsive in its administration of the filings required for mergers, acquisitions and other corporate transactions. Delaware has become a preferred domicile for most major American corporations and the Delaware corporate law and administrative practices have become comparatively well-known and widely understood. As a result of these factors, it is anticipated that the Delaware corporate law will provide greater efficiency, predictability and flexibility in the Company’s legal affairs than is presently available under Virginia law. In addition, Delaware case law provides a well-developed body of law defining the proper duties and decision-making processes expected of boards of directors in evaluating potential or proposed extraordinary corporate transactions.

Enhanced Ability to Attract and Retain Directors and Officers

The Board believes that the Reincorporation will enhance our ability to attract and retain qualified directors and officers, as well as encourage directors and officers to continue to make independent decisions in good faith on behalf of the Company. We are in a competitive industry and compete for talented individuals to serve on our management team and on our Board. The vast majority of public companies are incorporated in Delaware. Not only is Delaware law more familiar to directors, it also offers greater certainty and stability from the perspective of those who serve as corporate officers and directors. The parameters of director and officer liability are more extensively addressed in Delaware court decisions and are therefore better defined and better understood than under Virginia law. The Board believes that the Reincorporation will enhance our ability to recruit and retain directors and officers. We believe that the better understood and comparatively stable corporate environment afforded by Delaware law will enable us to compete more effectively with other public companies in the recruitment of talented and experienced directors and officers.

We have provided a discussion of differences between the Delaware and Virginia corporate laws below under the heading “Comparison of Shareholder Rights Before and After the Reincorporation.”

| Information Analysis Incorporated | 2021 Proxy Statement |

No Change in Business, Jobs, Physical Location, Etc.

The Reincorporation Proposal will effect a change in the legal domicile of the Company and other changes of a legal nature, the most significant of which are described below under the heading “-Comparison of Shareholder Rights Before and After the Reincorporation.” The Reincorporation Proposal will not result in any change in headquarters, business, jobs, management, location of any of our offices or facilities, number of employees, assets, liabilities or net worth (other than as a result of the costs incident to the Reincorporation). Our management, including all directors and officers, will remain the same in connection with the reincorporation and will have identical positions with DE CORP. To the extent the Reincorporation will require the consent or waiver of a third party, the Company will use commercially reasonable efforts to obtain such consent or waiver before completing the Reincorporation. If a material consent cannot be obtained, the Company will not proceed with the Reincorporation. The Reincorporation will not otherwise affect any of the Company’s material contracts with any third parties and the Company’s rights and obligations under such material contractual arrangements will continue as rights and obligations of DE CORP as a Delaware corporation. Because the Company’s corporate headquarters, management and employees are located in Austin, Virginia, the Company’s status as a Delaware corporation physically located in Virginia will require the Company to comply with reporting and tax obligations in Delaware. The Board has considered the additional franchise tax obligations and believes that the benefits discussed above outweigh the additional costs.

Comparison of Shareholder Rights Before and After the Reincorporation

The Reincorporation will effect some changes in the rights of the Company’s shareholders. This is as a result of differences between the Virginia Stock Corporation Act (“VSCA”) and the General Corporation Law of the State of Delaware (“DGCL”), as well as differences between each of the Company’s charter documents before and after the Reincorporation. Summarized below are the most significant differences between the rights of the Company’s shareholders before and after the Reincorporation. The differences between the current Amended and Restated Articles of Incorporation of the Company (the “Virginia Articles of Incorporation”) and the Bylaws of the Company (the “Virginia Bylaws”) and the proposed Delaware Certificate of Incorporation and Delaware Bylaws, as relevant to such rights, are noted within this summary. The summary below is not intended to be relied upon as an exhaustive list of all the differences or a complete description of the differences resulting from the Reincorporation. Furthermore, this summary is qualified in its entirety by reference to the DGCL, the Virginia Articles of Incorporation and Virginia Bylaws, the VSCA, and the Company’s proposed Delaware Certificate of Incorporation and Delaware Bylaws.

|

Delaware |

|

Virginia |

|

|

||

|

CORPORATE GOVERNANCE |

||

|

|

|

|

|

DE CORP’s certificate of incorporation, its bylaws and Delaware law, including the DGCL, govern the rights of holders of IAI common stock. |

|

IAI’s amended and restated articles of incorporation, its bylaws and Virginia law, including the VSCA, will govern the rights of holders of IAI common stock. |

|

|

||

|

ACTION BY WRITTEN CONSENT |

||

|

|

|

|

|

Unless the certificate of incorporation of a Delaware corporation otherwise provides, the DGCL permits the stockholders of a Delaware corporation to act by written consent in lieu of annual or special meeting of stockholders, provided that the holders of the outstanding stock having not less than the minimum number of votes that would be necessary to authorize such action at a meeting at which all shares entitled to vote thereon were present in person and voted. |

|

The VSCA provides that shareholders may act by written consent if all shareholders entitled to vote on the action deliver such consents. It is permissible under certain circumstances, if provided in a corporation’s articles of incorporation or by-laws to allow la majority written consent. Our articles and by-laws do not currently allow majority consents. |

| Information Analysis Incorporated | 2021 Proxy Statement |

|

Delaware |

|

Virginia |

|

|

||

|